NO.PZ2020021204000045

问题如下:

The quotes for a five-year interest rate swap are bid 3.20, ask 3.24. What swap would be entered by a company that can borrow for five years at 4.2% per year but wants to borrow at a floating rate? What rate of interest does the company end up borrowing at?

选项:

解释:

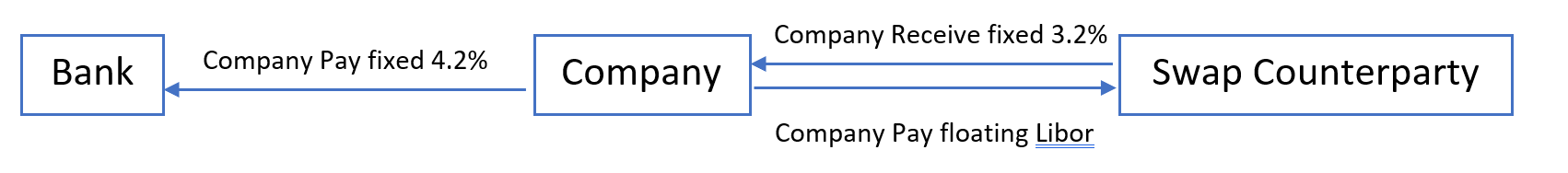

The company should arrange to receive fixed and pay floating to convert the fixed-rate loan to a floating-rate loan. It will accept the bid quote of 3.20. Its cash flows will be

• Receive 3.2%,

• Pay 4.2%, and

• Pay Libor.

These net to Libor plus 1 %.

可以画一个BANK、company和dealer的流程图吗,没太懂,公司可以借固定,不是应该先把固定利率给到dealer,然后dealer把浮动利率给到company吗,难道这不叫从借fix变成了借float?感觉我的理解跟答案不太一样,请老师帮我看下我的理解哪里出问题了。谢谢