NO.PZ2018062016000010

问题如下:

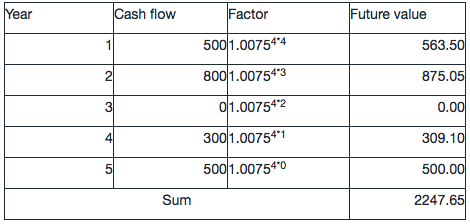

Mary has a separate account for her annual savings which has a stated annual rate of 3% and compounding quarterly. At the end of each year, she transfers unequal cash flows into this account. Year 1: $500, Year 2: $800, Year 4: $300, Year 5: $500. How much will Mary save for her account at the end of year 5?

选项:

A.

$2246.81

B.

$2247.65

C.

$2281.00

解释:

B is correct.