NO.PZ2020033001000032

问题如下:

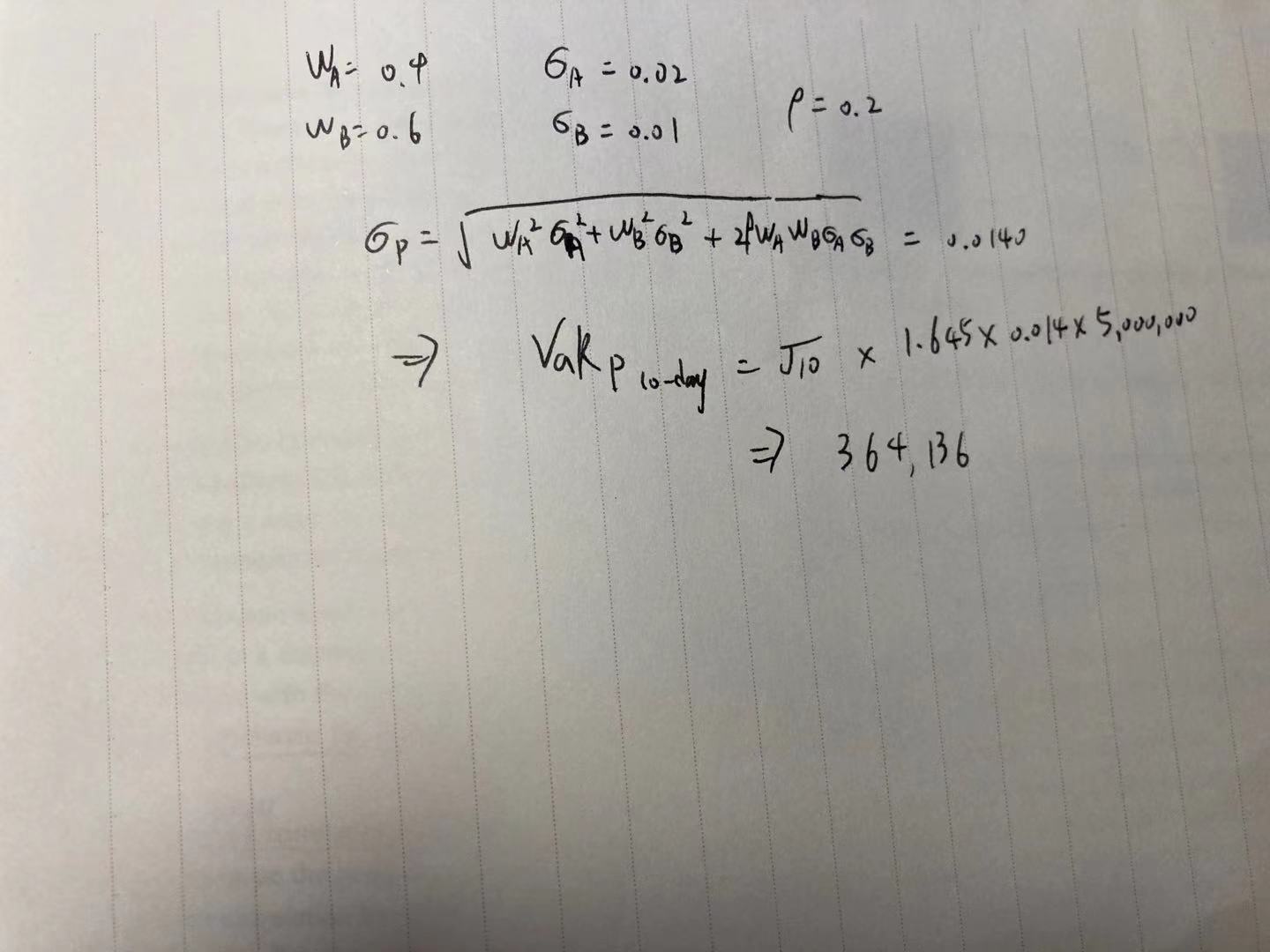

Suppose an investment manager manages an investment portfolio with two assets, of which asset A is $ 2 million and asset B is $ 3 million. The correlation between the two assets is 0.2, and the standard deviations of the daily returns of assets A and B are 2% and 1%, respectively. Assuming that the expected daily return is 0, at a 95% confidence level (α = 1.645), what is the 10-day risk value (VaR) of the portfolio?

选项:

A.$65800

B.$49350

C.$89800

D.$283972

解释:

D is correct.

考点:组合VaR的计算

解析:首先资产A和B的daily VaR分别是:

A:2million*2%*1.645=65800

B:3million*1%*1.645=49350

他们两个组合的daily var就等于(65800^2+49350^2+2*0.2*65800*49350)^0.5=89800

那么10天的var就等于89800*SQRT(10) 得到283972