问题如下:

8. Based on Exhibit 4 and Intern 1’s analysis, Xavier Corporation’s sustainable dividend payout ratio is closest to:

选项:

A.

43.4%.

B.

44.6%.

C.

56.6%.

解释:

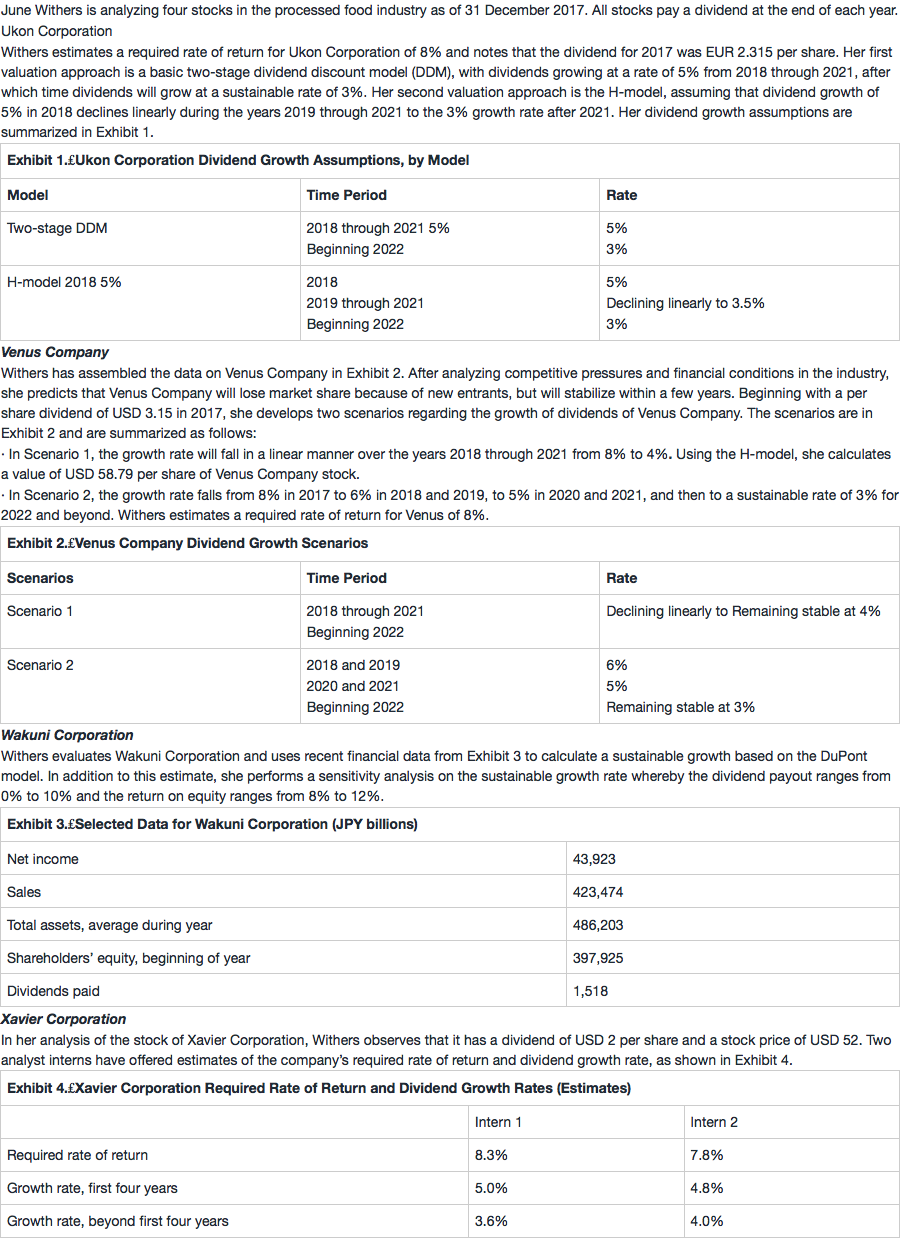

C is correct because it is based on the sustainable growth rate and the required rate of return:

Sustainable growth rate = (b in mature phase) × (Return on equity)

= (1 – Dividend payout) × (Return on equity)

0.036 = (1 – Dividend payout) × 0.083

Solving for the dividend payout ratio, the dividend payout = 56.627% ≈ 56.6%.

看了之前老师的解释,没有看懂,想再问一下为啥不能用Re=D/P+g的公式反推dividend payout ratio?