问题如下:

It is not always apparent how risk should be quantified for a given bank when there are many different possible risk measures to consider. Prior to defining specific measures, one should be aware of the general characteristics of ideal risk measures. Such measures should be intuitive, stable, easy to understand, coherent, and interpretable in economic terms. In addition, the risk decomposition process must be simple and meaningful for a given risk measure. Standard deviation, value at risk (VaR), expected shortfall (ES), and spectral and distorted risk measures are commonly used measures to calculate economic capital. However, it is not easy to select a risk measure to calculate economic capital, as each measure has its respective pros and cons. Which of the following statements pertaining to the pros and cons of these risk measures is not accurate?

选项:

A.Standard deviation does not have the property of monotonicity, and therefore, it is not coherent.

B.VaR does not have the property of subadditivity, and therefore; it is not coherent.

C.ES is not stable regardless of the loss distribution.

D.Spectral and distorted risk measures are neither intuitive nor commonly used in practice.

解释:

C is correct.

考点Coherent Risk Measures

解析Expected shortfall’s stability as a measure of risk depends on the loss distribution.

什么是Distorted risk measure?

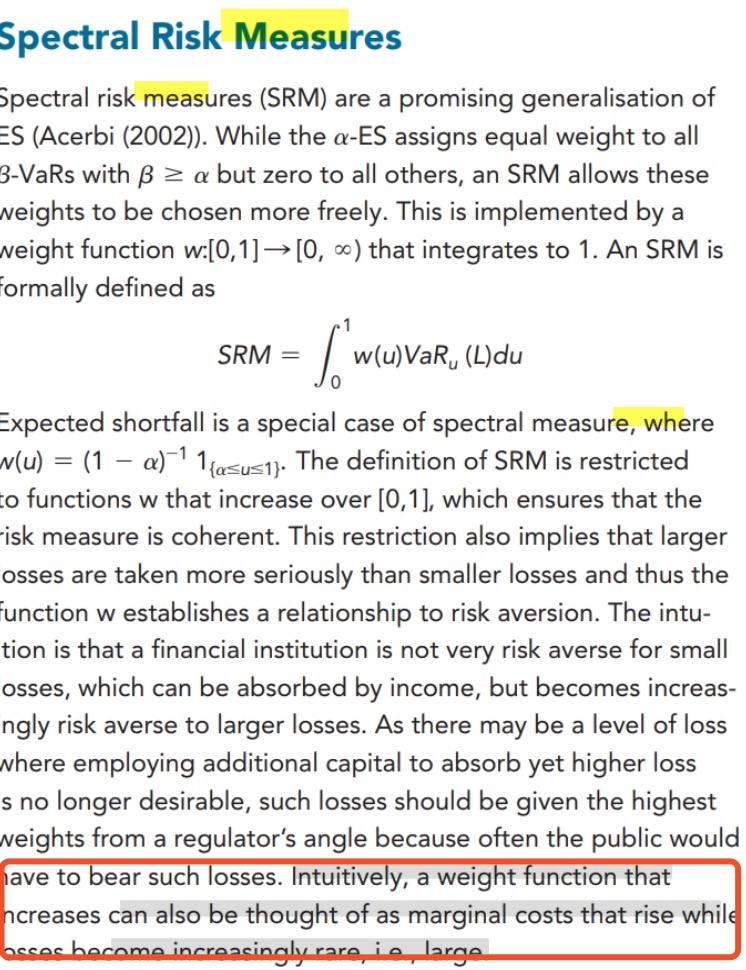

另外为什么spectral不直观常用?不是说VaR和ES都是spectral的特殊形式吗,而且加上图片看上去很直观,不是应该属于直管常用么