问题如下:

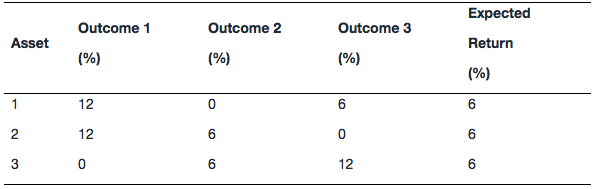

An analyst has made the following return projections for each of three possible outcomes with an equal likelihood of occurrence:

If the analyst constructs two-asset portfolios that are equally-weighted, which pair of assets has the lowest expected standard deviation?

选项:

A.Asset 1 and Asset 2.

B.Asset 1 and Asset 3.

C.Asset 2 and Asset 3.

解释:

C is correct.

An equally weighted portfolio of Asset 2 and Asset 3 will have the lowest portfolio standard deviation, because for each outcome, the portfolio has the same expected return (they are perfectly negatively correlated).

请问下,这道题会用到补充内容,sigma_p^2=1/n*sigma_bar+(n-1)/n*Cov_bar这个公式么?