问题如下:

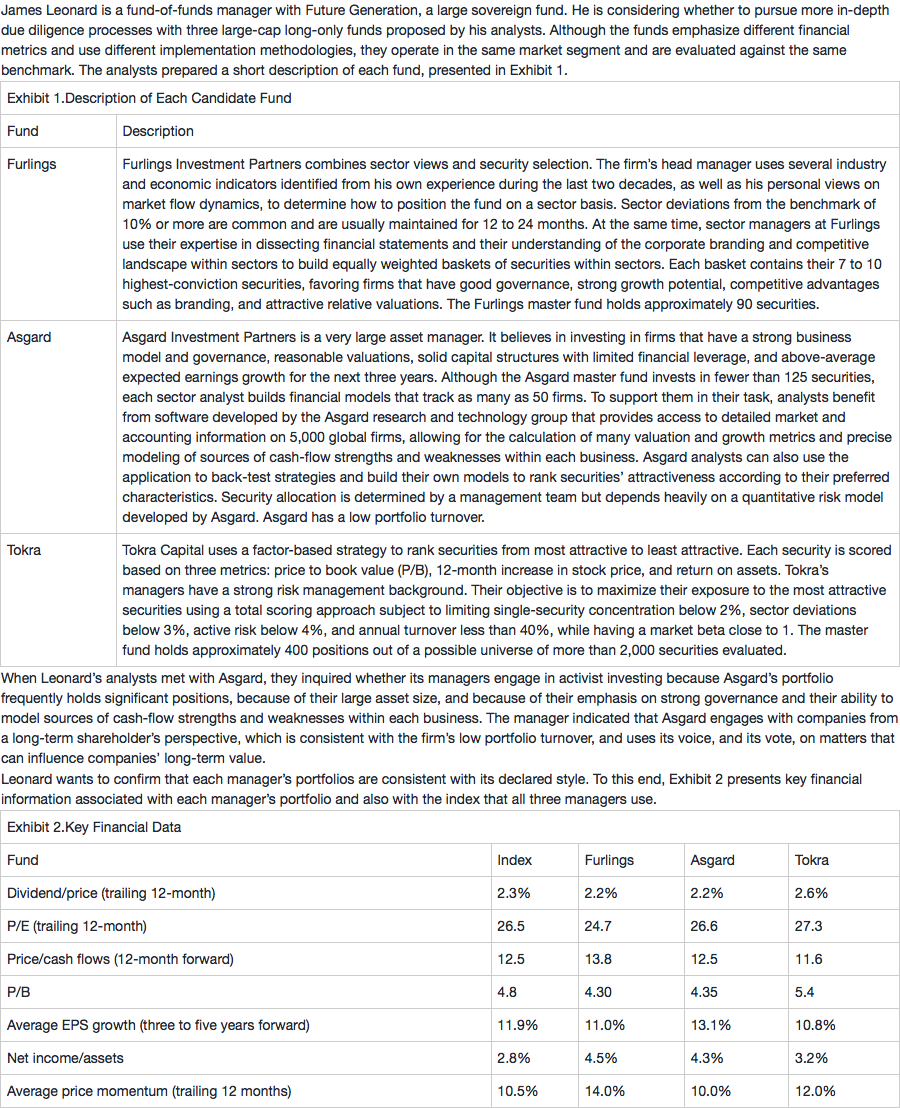

James Leonard is a fund-of-funds manager with Future Generation, a large sovereign fund. He is considering whether to pursue more in-depth due diligence processes with three large-cap long-only funds proposed by his analysts. Although the funds emphasize different financial metrics and use different implementation methodologies, they operate in the same market segment and are evaluated against the same benchmark. The analysts prepared a short description of each fund, presented in Exhibit 1.

When Leonard’s analysts met with Asgard, they inquired whether its managers engage in activist investing because Asgard’s portfolio frequently holds significant positions, because of their large asset size, and because of their emphasis on strong governance and their ability to model sources of cash-flow strengths and weaknesses within each business. The manager indicated that Asgard engages with companies from a long-term shareholder’s perspective, which is consistent with the firm’s low portfolio turnover, and uses its voice, and its vote, on matters that can influence companies’ long-term value.

Leonard wants to confirm that each manager’s portfolios are consistent with its declared style. To this end, Exhibit 2 presents key financial information associated with each manager’s portfolio and also with the index that all three managers use.

Which manager is most likely to get caught in a value trap?

选项:

A. Furlings

B. Asgard

C. Tokra

解释:

C is the correct answer. A value trap occurs when a stock that appears to have an attractive valuation because of a low P/E and/or P/B multiple (or other relevant value proxies) appears cheap only because of its worsening growth prospects. Although a pitfall such as value trap is more common in fundamental investing, a quantitative process that relies on historical information and does not integrate future expectations about cash flows or profitability may be unable to detect a value trap.

A is an incorrect answer. Although Furlings is a top-down manager, its sector portfolios are built through investing in a small number of high-conviction securities after its analysts have dissected the financial statements and analyzed the competitive landscape and growth prospects. Managers at Furlings are more likely than managers at Tokra to be aware of the significant deteriorating prospects of a security they are considering for investment.

B is an incorrect answer. One of Asgard’s investment criteria is identifying firms that have good potential cash flow growth over the next three years. The firm has access to database and support tools, allowing its analysts to evaluate many potential growth metrics. Managers at Asgard are more likely than managers at Tokra to be aware of the significant deteriorating prospects of a security they are considering for investment.

这道题他做P/B分析如果选pb大的,找growth型,是不是就不会出现value trap?