问题如下:

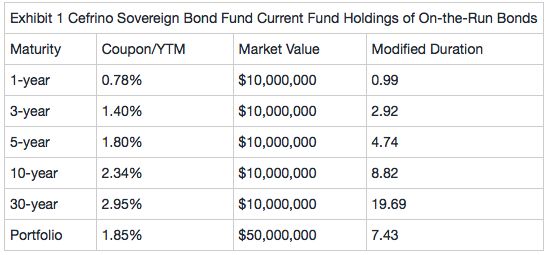

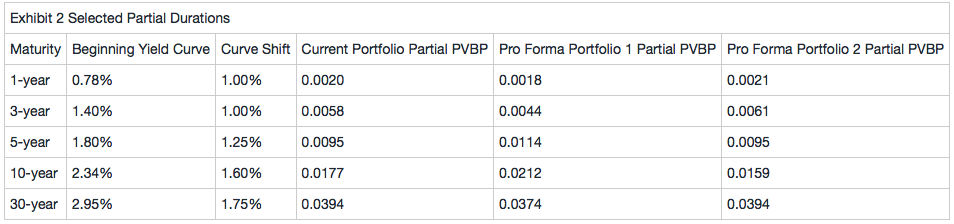

Edgarton evaluates the Fund’s positions from Exhibit 1 along with two of his pro forma portfolios, which are summarized in Exhibit 2:

Edgarton expects a steepening yield curve, with short-term yields rising by 1.00% and long-term yields rising by more than 1.00%.

Based on Exhibits 1 and 2, which of the following portfolios is most likely to have the best performance given Edgarton’s yield curve expectations?

选项:

A.

Current Portfolio

B.

Pro Forma Portfolio 1

C.

Pro Forma Portfolio 2

解释:

C is correct.

Given Edgarton’s expectation for a steepening yield curve, the best strategy is to shorten the portfolio duration by more heavily weighting shorter maturities. Pro Forma Portfolio 2 shows greater partial duration in the 1- and 3-year maturities relative to the current portfolio and the least combined exposure in the 10- and 30-year maturities of the three portfolios. The predicted change is calculated as follows:

Predicted change = Portfolio par amount × partial PVBP × (-curve shift in bps)/100

请问一下,这个题目可以不通过计算,得出答案吗?