问题如下:

2. Using an asset-based approach, the value (net of debt) of Oakstar is closest to:

选项:

A.$62,250,000.

B.$87,250,000.

C.$199,750,000.

解释:

B is correct.

In the absence of market value data for assets and liabilities, the analyst usually must use book value data (the reading explicitly makes the assumption that book values accurately reflect market values as well). Except for timberland, market values for assets are not available. Thus, all other assets are assumed to be valued by their book values, which sum to $500,000 + $25,000 + $50,000 + $750,000 = $1,325,000. The value of the land is determined by the value of $8,750 per hectare for properties comparable to Oakstar’s. Thus, the value of Oakstar’s land is $8,750 × 10,000 = $87,500,000. Liabilities are assumed to be worth the sum of their book value or $1,575,000. Thus, Estimated value = Total assets

老师,我这边主要有三个问题:

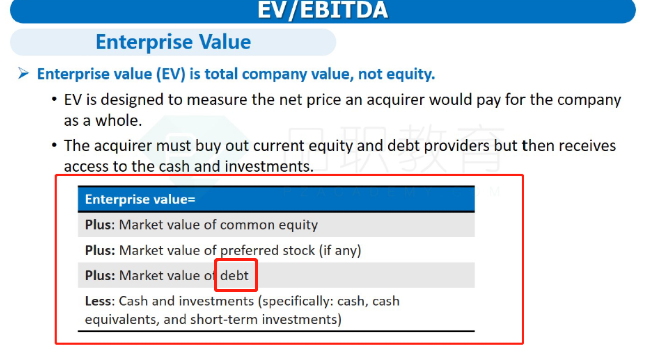

1、请问此处为什么不用扣除现金?我看到过往解析中老师解释:”asset based approach就是总资产减去总负债,如果是计算EV的话,EV=股权价值+净债务,其中净债务是“有息负债-现金”。注意区分“。想问下所谓的区别在哪里?asset based approach计算出的也是EV吧。。我理解的EV=V(equity)+V(liability), 此处的V(liability)是liability的market value(只是因为通常没有market value才近似用liability的book value),为什么这里老师解析是要用净债务?这在基础班哪页讲义中?为什么我一点印象都没有。。。

2、另外讲义中似乎对asset based方法没有过多说明,看本题解析,在实际计算时是有market value的按照market value,没有的就按照Book value,是这样吗?