问题如下:

Corporate bond secondary market trading most often occurs:

选项:

A.

on a book-entry basis.

B.

on organized exchanges.

C.

prior to settlement at T + 1.

解释:

A is correct.

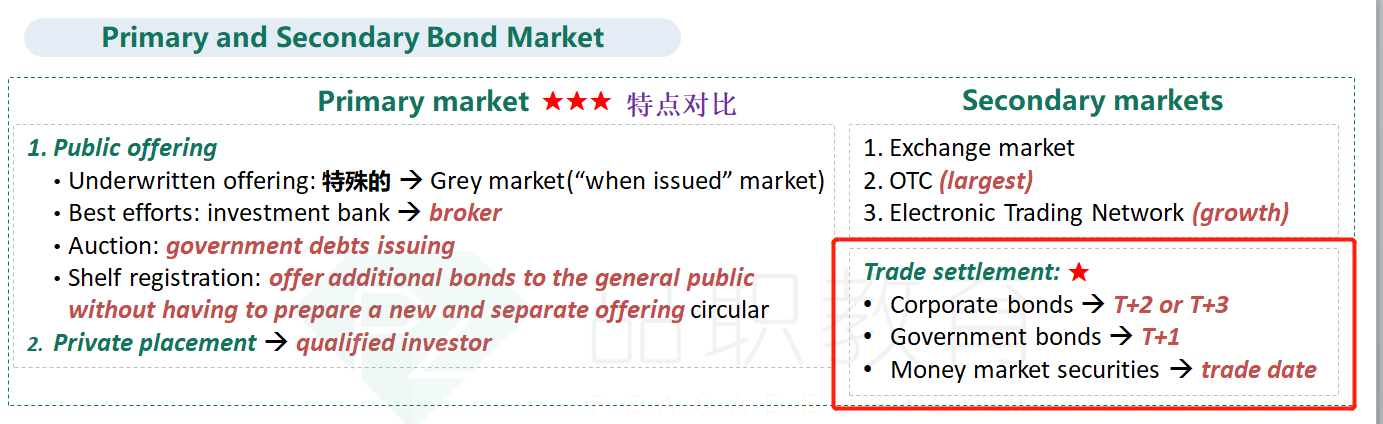

The vast majority of corporate bonds are traded in over-the-counter (OTC) markets that use electronic trading platforms through which users submit buy and sell orders. Settlement of trades in the OTC markets occurs by means of a simultaneous exchange of bonds for cash on the books of the clearing system "on a paperless, computerized book-entry basis."

请问强化班14页不是写着T+0价格吗?哪些交割时间是需要掌握的,时间是多少?能帮忙总结一下吗?