问题如下:

The bond equivalent yield of a 180-day banker’s acceptance quoted at a discount rate of 4.25% for a 360-day year is closest to:

选项:

A.4.31%.

B.4.34%.

C.4.40%.

解释:

C is correct.

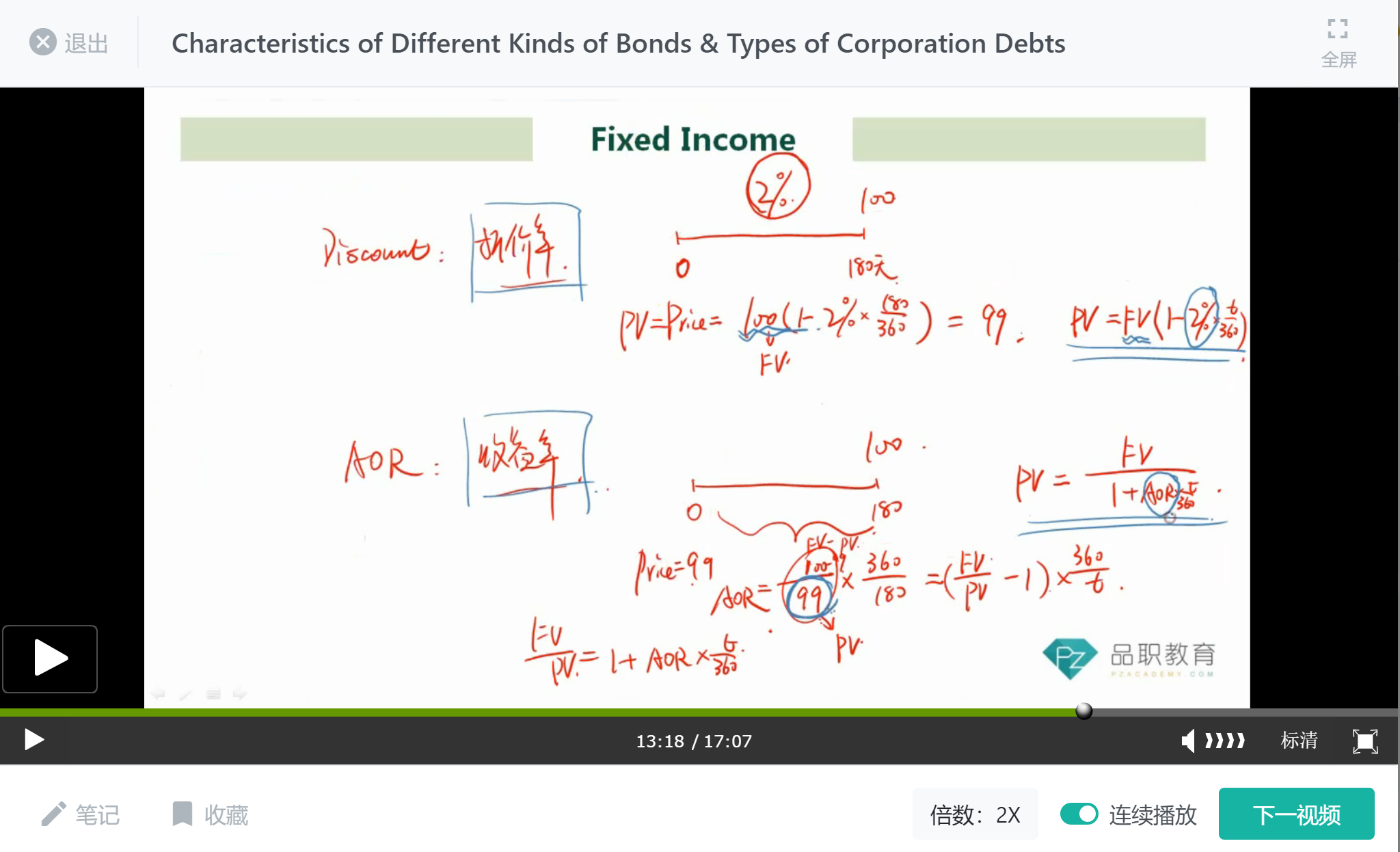

The bond equivalent yield is closest to 4.40%. The present value of the banker’s acceptance is calculated as:

where:

PV = present value, or price of the money market instrument

FV = future value paid at maturity, or face value of the money market instrument

Days = number of days between settlement and maturity

Year = number of days in the year

DR = discount rate, stated as an annual percentage rate

PV = 100 × (1 – 0.02125)

PV = 100 × 0.97875

PV = 97.875

The bond equivalent yield (AOR) is calculated as:

where:

PV = present value, principal amount, or the price of the money market instrument

FV = future value, or the redemption amount paid at maturity including interest

Days = number of days between settlement and maturity

Year = number of days in the year

AOR = add-on rate (bond equivalent yield), stated as an annual percentage rate

AOR = 2.02778 × 0.02171

AOR = 0.04402, or approximately 4.40%

Note that the PV is calculated using an assumed 360-day year and the AOR (bond equivalent yield) is calculated using a 365-day year.

何老师在基础班和强化班讲这个AOR的计算好像都是用的360天算的。。。我隐约记得好像说一般AOR都是用365算的,除非题目有特殊说明用360天算。考试中遇到的话是就统一用365天算吗,特别是遇到这种用这两个天数算都有答案的。。。