问题如下:

Which of the following conclusion is

correct from the real case of Northern Rock?

选项:

A.

If the bank had been managed a little more

conservatively and had paid more attention to ensuring that it had access to

funding, it might have survived.

Companies should not use forward and futures

contracts, as these contracts would cause cash outflows.

Banks should not rely on selling short-term

debt instruments for its funding.

If

the bank’s assets were sufficient to cover its liabilities, it would have survived.

解释:

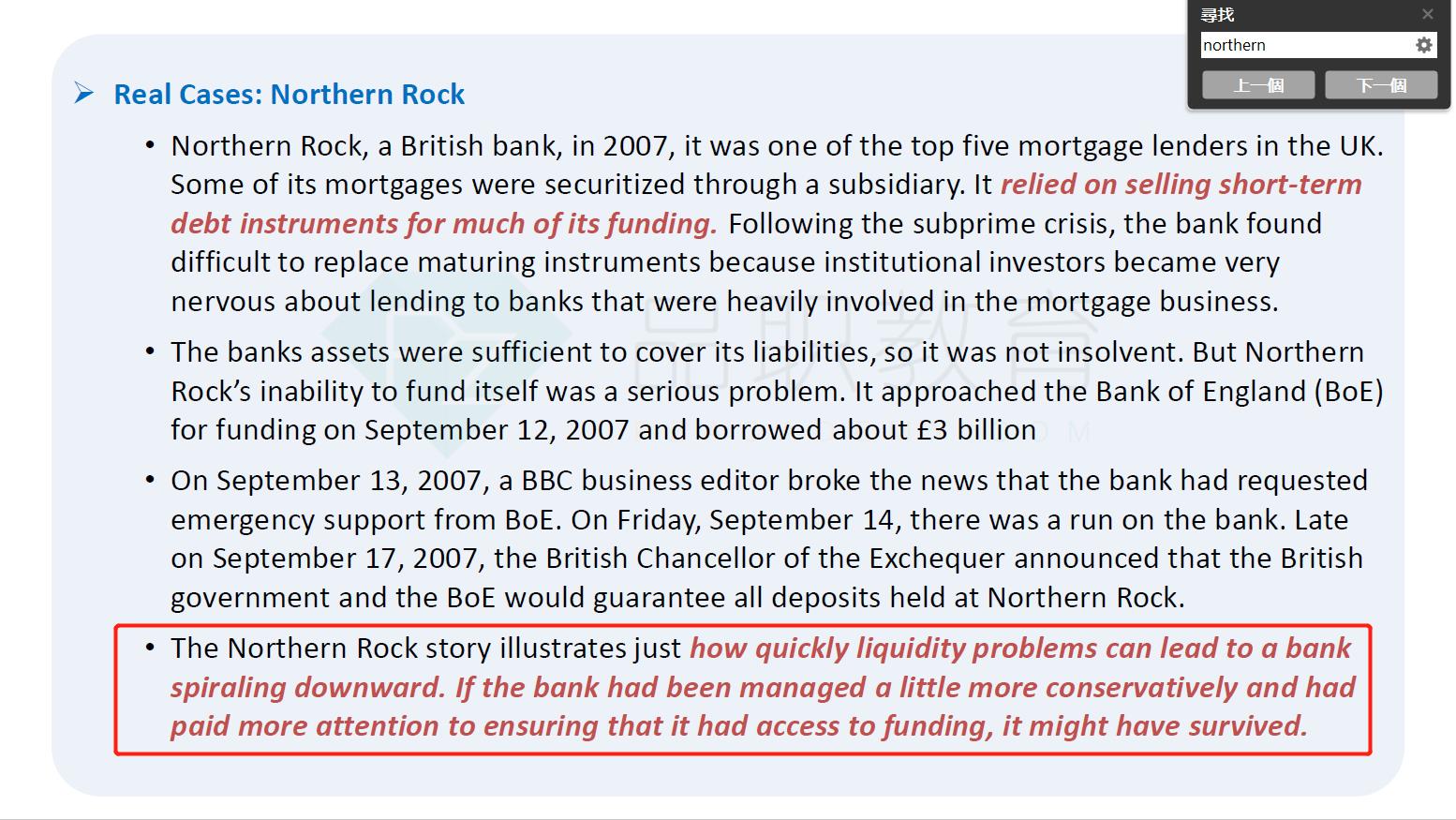

考点:对Liquidity Funding Risk的理解

答案:A选项表述正确,本题选A

解析:

案例Northern Rock的Conclusion为:how quickly liquidity problems can lead to a bank spiraling downward

If the bank had been managed a little more conservatively and had paid more

attention to ensuring that it had access to funding, it might have survived.

C感觉也对啊,北岩就是因为太依赖卖短期债这个方式才导致GG的啊