问题如下:

When estimating the required rate of return of the bond that are not actively traded or are not issued yet, we choose matrix pricing method and use the figure of comparable bonds that:

选项:

A.

have different credit quality

B.

are more frequently traded

C.

have different coupon rates

解释:

B is correct.

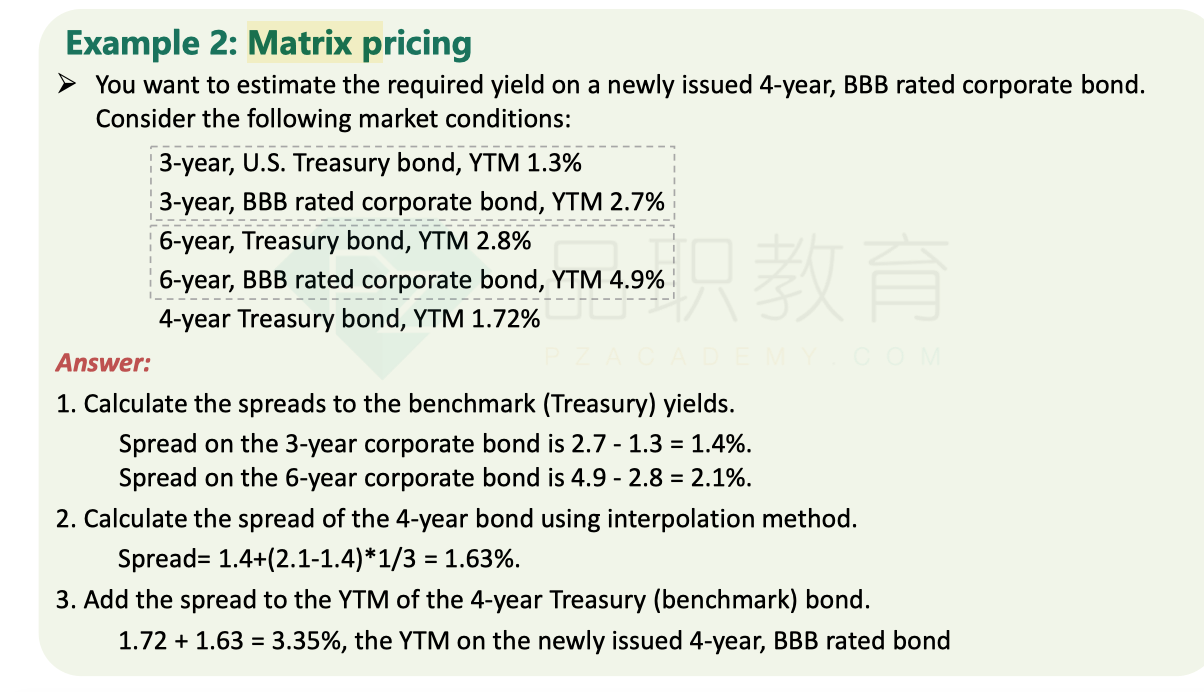

When estimating the required rate of return of the bond that are not actively traded or are not issued yet, we choose matrix pricing method and use comparable bonds that have similar credit quality, coupon rates, time-to-maturity and are more frequently traded.

老师可以把matric pricing的pricing方法知识点再列一下不,谢谢!

同学您好,

同学您好,