问题如下:

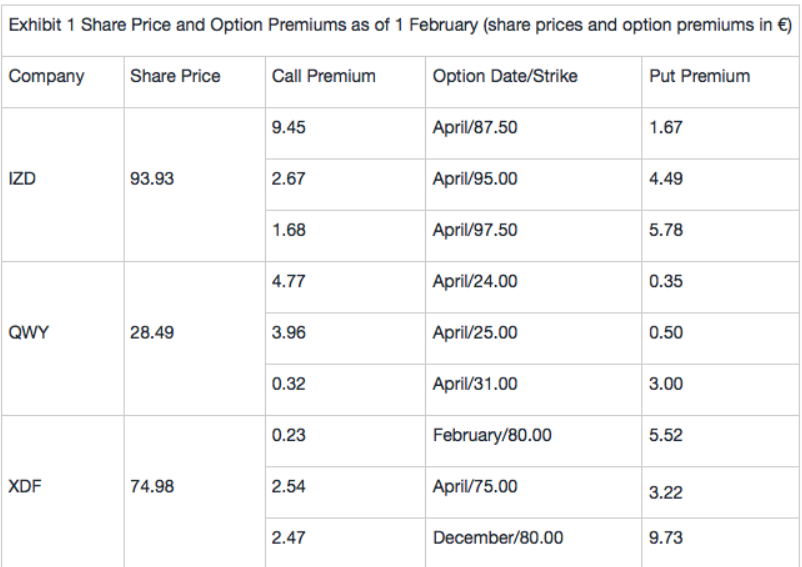

Aline Nuñes, a junior analyst, works in the derivatives research division of an international securities firm. Nuñes’s supervisor, Cátia Pereira, asks her to conduct an analysis of various option trading strategies relating to shares of three companies: IZD, QWY, and XDF. On 1 February, Nuñes gathers selected option premium data on the companies, presented in Exhibit 1.

Nuñes reviews the following option strategies relating to QWY:

Strategy 4: Implementing a protective put position in QWY using the April €25.00 strike option

Strategy 5: Buying 100 shares of QWY, buying the April €24.00 strike put option, and writing the April €31.00 strike call option

Strategy 6: Implementing a bear spread in QWY using the April €25.00 and April €31.00 strike options

Based on Exhibit 1, the maximum loss per share that would be incurred by implementing Strategy 4 is:

选项:

A.

€2.99.

B.

€3.99.

C.

unlimited.

解释:

B is correct.

Strategy 4 is a protective put position, which is a combination of a long position in shares and a long put option. By purchasing the €25.00 strike put option, Nuñes would be protected from losses at QWY share prices of €25.00 or lower. Thus, the maximum loss per share from Strategy 4 would be the loss of share value from €28.49 to €25.00 (or €3.49) plus the put premium paid for the put option of €0.50: S0 – X + p0 = €28.49 – €25.00 + €0.50 = €3.99.

这道题目看不到表格哦