问题如下:

Based on the following information, what are the the risk-neutral and real-world default probabilities?

• Market price of bond is 92.

• Liquidity premium is 1%.

• Credit risk premium is 2%.

• Risk-free rate is 2.5%.

• Expected inflation is 1.5%.

• Recovery rate is 0%.

选项:

解释:

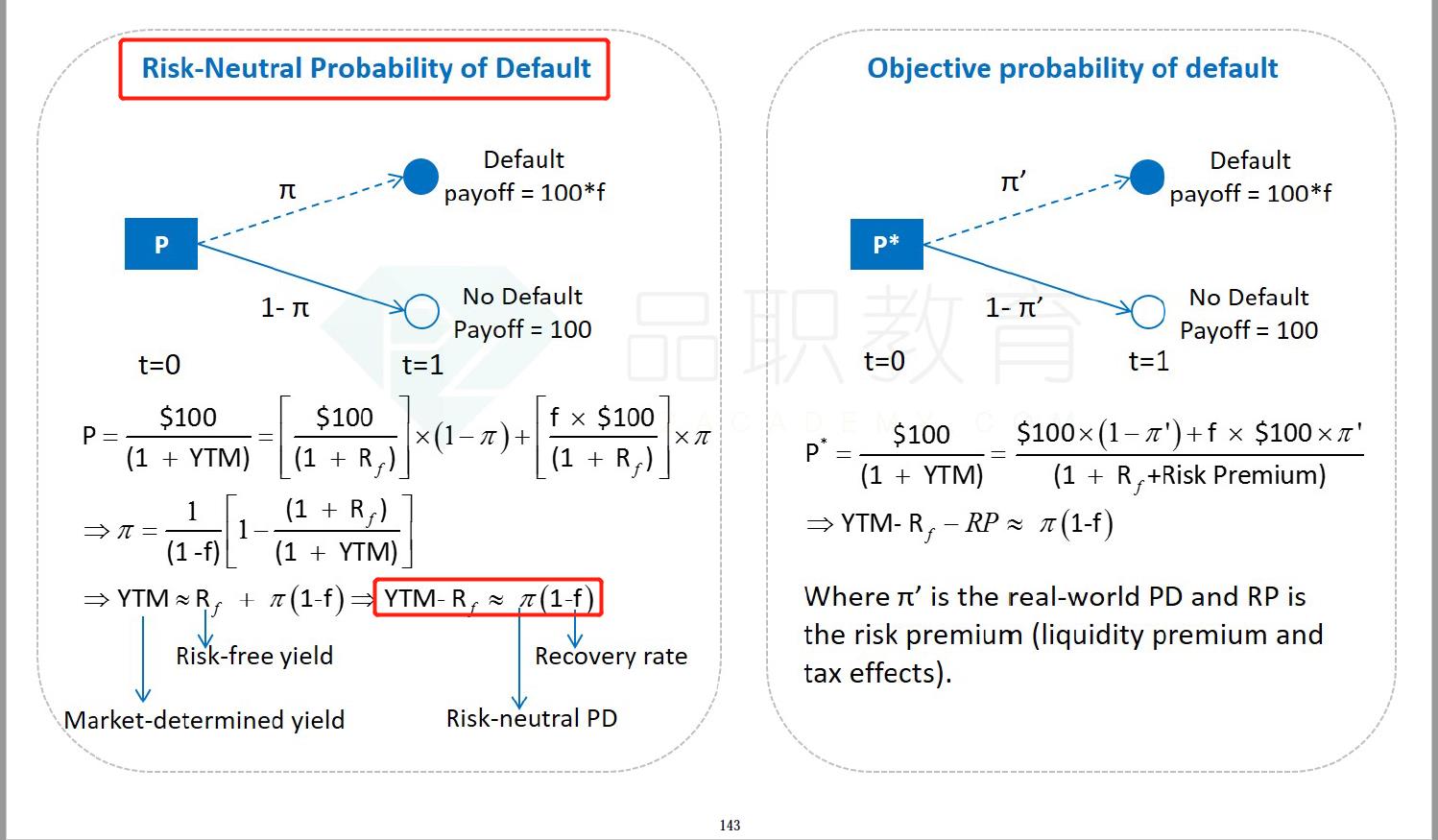

B The risk-neutral default probability is approximately 8% because the market price is 92% of par.

risk-neutral probability = real-world probability + credit risk premium + liquidity premium

8% = real-world probability + 2% + 1%

real-world probability = 8% - 3% = 5%

risk-neutral 是啥意思?

为啥它还等于 = real default + 流动性+风险补偿?

这是在哪里讲的啊?