请问老师,这一题答案给的是这个人的bias除了anchoring还有confirmation bias、conservatism bias、illusion of control bias和overconfidence bias。这道题我完全没有看出来这个人哪里有confirmation bias、conservatism bias、illusion of control bias和overconfidence bias,求老师解答,感谢!

王琛_品职助教 · 2020年10月11日

公司背景:蓝筹

has been a manager at a blue-chip technology firm for 30 years

A “blue-chip” share is one from a well-recognized company that is considered to be high quality but low risk.

This term generally refers to a company that has a long history of earnings and paying dividends.

组合背景:集中且为自家公司

He has consistently invested in the company’s stock and employee stock options. Samuel has accumulated a portfolio of $1.8 million, of which 80% is invested in his firm

负面信息 1

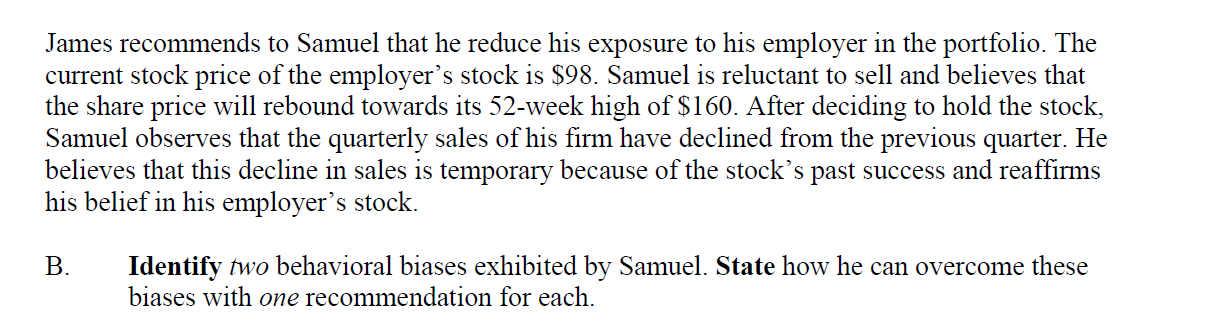

The current stock price of the employer’s stock is $98. Samuel is reluctant to sell and believes that the share price will rebound towards its 52-week high of $160

负面信息 2

observes that the quarterly sales of his firm have declined from the previous quarter

1 股价会反弹至高点

Samuel is reluctant to sell and believes that the share price will rebound towards its 52-week high of $160.

2 基本面恶化只是暂时

He believes that this decline in sales is temporary because of the stock’s past success and reaffirms his belief in his employer’s stock.

好了,有了 “information” 和 “belief”,咱就可以确认行为偏差了

Hold a disproportionate amount of their investment assets in their employing company’s stock because they believe in their company and are convinced of its favorable prospects. Favorable information is cited, and unfavorable infor-mation is ignored.

Maintain or be slow to update a view or a forecast, even when presented with new information

Lead investors to inadequately diversify portfolios.

Researchers have found that some investors prefer to invest in companies that they may feel they have some control over, like the companies they work for, leading them to hold concentrated positions.

Hold poorly diversified portfolios

歪fine朱 · 2020年10月12日

震撼了!这个答案!