问题如下:

Which of the following statements is correct regarding spread measures?

选项: The yield spread and i-spread are

equal if the benchmark yield curve is flat.

The z-spread = OAS for callable bonds.

C.The z-spread must be used for mortgage-backed securities (MBS).

D.The CDS spread is used only with corporate bonds.

解释:

A If the yield curve is flat, there is no need for interpolation. Therefore, yield spread = i-spread. z-spread > OAS for callable bonds. OAS must be used for MBS. CDS measures the credit risk from any security with positive probability of default including sovereign and municipal bonds.

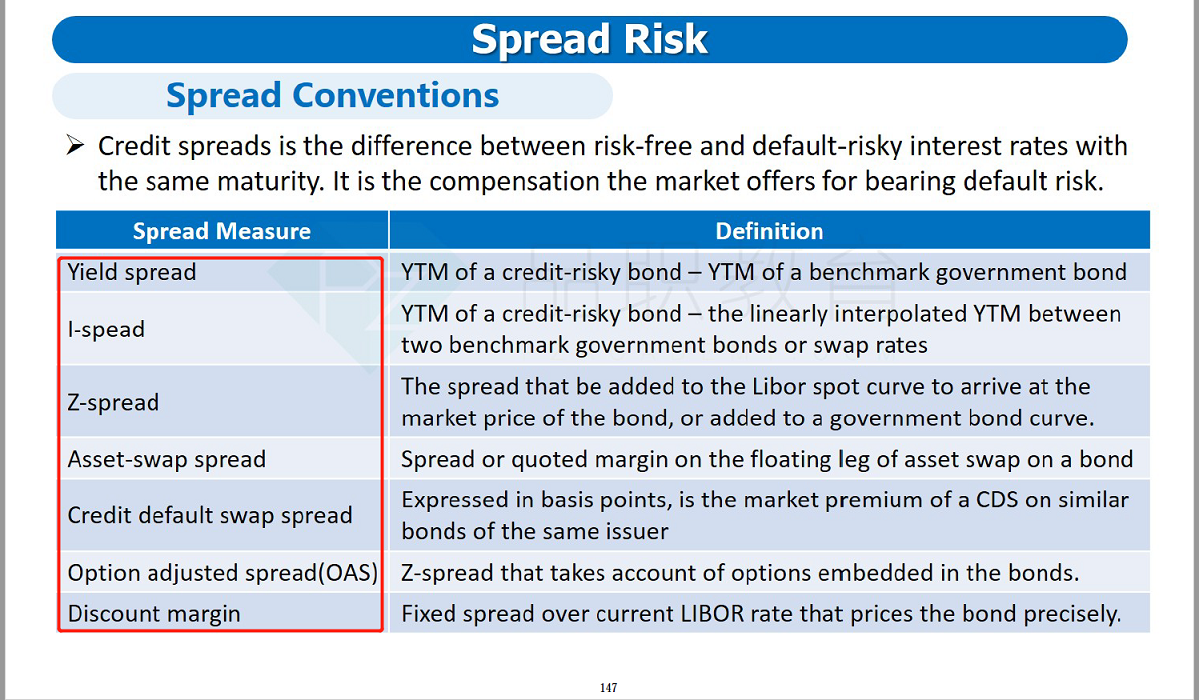

这些spread是在ppt

那一页讲的?