问题如下:

Jacob Daniel is the chief investment officer at a US pension fund sponsor, and Steven Rae is an analyst for the pension fund who follows consumer/noncyclical stocks. At the beginning of 2009, Daniel asks Rae to value the equity of Tasty Foods Company for its possible inclusion in the list of approved investments. Tasty Foods Company is involved in the production of frozen foods that are sold under its own brand name to retailers.

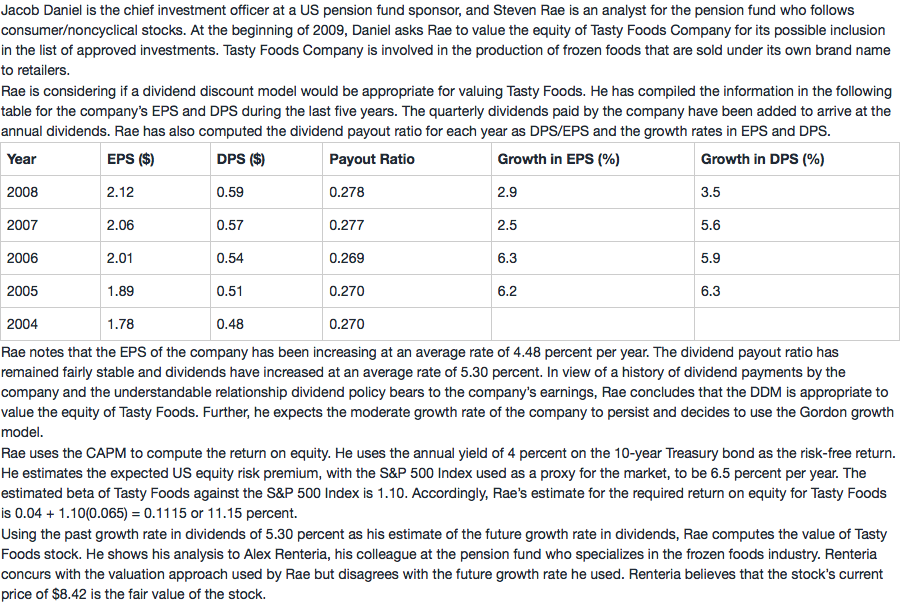

Rae is considering if a dividend discount model would be appropriate for valuing Tasty Foods. He has compiled the information in the following table for the company’s EPS and DPS during the last five years. The quarterly dividends paid by the company have been added to arrive at the annual dividends. Rae has also computed the dividend payout ratio for each year as DPS/EPS and the growth rates in EPS and DPS.

Rae notes that the EPS of the company has been increasing at an average rate of 4.48 percent per year. The dividend payout ratio has remained fairly stable and dividends have increased at an average rate of 5.30 percent. In view of a history of dividend payments by the company and the understandable relationship dividend policy bears to the company’s earnings, Rae concludes that the DDM is appropriate to value the equity of Tasty Foods. Further, he expects the moderate growth rate of the company to persist and decides to use the Gordon growth model.

Rae uses the CAPM to compute the return on equity. He uses the annual yield of 4 percent on the 10-year Treasury bond as the risk-free return. He estimates the expected US equity risk premium, with the S&P 500 Index used as a proxy for the market, to be 6.5 percent per year. The estimated beta of Tasty Foods against the S&P 500 Index is 1.10. Accordingly, Rae’s estimate for the required return on equity for Tasty Foods is 0.04 + 1.10(0.065) = 0.1115 or 11.15 percent.

Using the past growth rate in dividends of 5.30 percent as his estimate of the future growth rate in dividends, Rae computes the value of Tasty Foods stock. He shows his analysis to Alex Renteria, his colleague at the pension fund who specializes in the frozen foods industry. Renteria concurs with the valuation approach used by Rae but disagrees with the future growth rate he used. Renteria believes that the stock’s current price of $8.42 is the fair value of the stock.

1. Which of the following is closest to Rae’s estimate of the stock’s value?

选项:

A.$10.08.

B.$10.54.

C.$10.62.

解释:

C is correct.

Using the Gordon growth model,

$$V_0=\frac{D_1}{r-g}=\frac{0.59(1+0.0530)}{0.1115-0.0530}=\$10.62$$

这道题时间是2009年初,为什么不能直接用表中2008年末的EPS增长率?如果以后题目给了多期的增长率,在没有明确说明的情况下应该直接用最近一期的数据还是平均数?谢谢