问题如下:

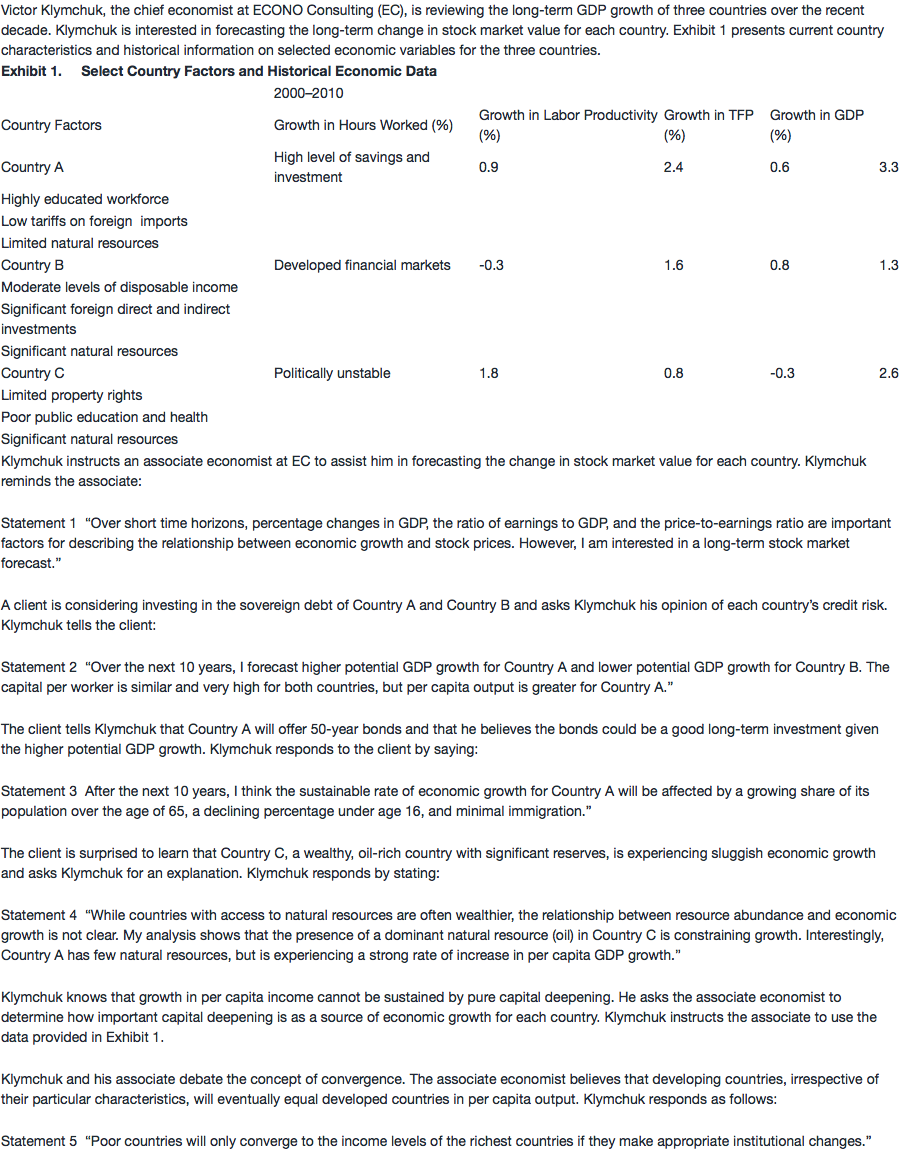

Victor Klymchuk, the chief economist at ECONO Consulting (EC), is reviewing the long-term GDP growth of three countries over the recent decade. Klymchuk is interested in forecasting the long-term change in stock market value for each country. Exhibit 1 presents current country characteristics and historical information on selected economic variables for the three countries.

Exhibit 1. Select Country Factors and Historical Economic Data

Klymchuk instructs an associate economist at EC to assist him in forecasting the change in stock market value for each country. Klymchuk reminds the associate:

Statement 1 “Over short time horizons, percentage changes in GDP, the ratio of earnings to GDP, and the price-to-earnings ratio are important factors for describing the relationship between economic growth and stock prices. However, I am interested in a long-term stock market forecast.”

A client is considering investing in the sovereign debt of Country A and Country B and asks Klymchuk his opinion of each country’s credit risk. Klymchuk tells the client:

Statement 2 “Over the next 10 years, I forecast higher potential GDP growth for Country A and lower potential GDP growth for Country B. The capital per worker is similar and very high for both countries, but per capita output is greater for Country A.”

The client tells Klymchuk that Country A will offer 50-year bonds and that he believes the bonds could be a good long-term investment given the higher potential GDP growth. Klymchuk responds to the client by saying:

Statement 3 After the next 10 years, I think the sustainable rate of economic growth for Country A will be affected by a growing share of its population over the age of 65, a declining percentage under age 16, and minimal immigration.”

The client is surprised to learn that Country C, a wealthy, oil-rich country with significant reserves, is experiencing sluggish economic growth and asks Klymchuk for an explanation. Klymchuk responds by stating:

Statement 4 “While countries with access to natural resources are often wealthier, the relationship between resource abundance and economic growth is not clear. My analysis shows that the presence of a dominant natural resource (oil) in Country C is constraining growth. Interestingly, Country A has few natural resources, but is experiencing a strong rate of increase in per capita GDP growth.”

Klymchuk knows that growth in per capita income cannot be sustained by pure capital deepening. He asks the associate economist to determine how important capital deepening is as a source of economic growth for each country. Klymchuk instructs the associate to use the data provided in Exhibit 1.

Klymchuk and his associate debate the concept of convergence. The associate economist believes that developing countries, irrespective of their particular characteristics, will eventually equal developed countries in per capita output. Klymchuk responds as follows:

Statement 5 “Poor countries will only converge to the income levels of the richest countries if they make appropriate institutional changes.”

4. Based solely on the predictions in Statement 2, over the next decade Country B’s sovereign credit risk will most likely:

选项:

A.increase.

B.decrease.

C.not change.

解释:

A is correct.

Credit rating agencies consider the growth rate of potential GDP when evaluating the credit risk of sovereign debt. The chief economist’s expectation for lower potential GDP growth for Country B over the next decade increases the perceived credit risk of its sovereign bonds.

考点:关于 potential GDP 很细的知识点

解析:GDP的增长可以用来衡量企业债和国债的信用风险。如果一个国家有很高的potential GPD growth rate, 那么这个国家将来就有足够的钱偿还外债,它的信用风险会很低,题目中说到国家B的potential GPD growth rate是很低的,也就表明该国信用质量将来会变差。

老师这里的per capita output是什么意思啊?对应哪个公式?谢谢