问题如下:

Which of the following fund manager’s investing approach is most consistent with fundamental management?

Buffett: The Buffett master fund holds approximately 65 securities and performs in depth analysis on each one of them. Buffett use his expertise in analyzing financial statements on individual companies and his understanding of the corporate branding, competitive landscape and governance, within sectors to build equally weighted baskets of securities within sectors.

Matt: Security allocation depends heavily on a quantitative risk model developed by Matt. Matt benefits from software developed by the fund‘s research and technology group that provides access to detailed market and accounting information on 5,000 global firms. Matt can also use the application to back-test strategies and build his own models to rank securities’ attractiveness.

Satyam: Satyam’s objective is to maximize their exposure to the most attractive securities using a total scoring approach subject to limiting single-security concentration below 2%, sector deviations below 3%, active risk below 4%, and annual turnover less than 40%, while having a market beta close to 1. Satyam holds approximately 1000 positions out of a possible universe of more than 5,000 securities evaluated.

选项:

A. Buffett

B. Matt

C. Satyam

解释:

A is correct.

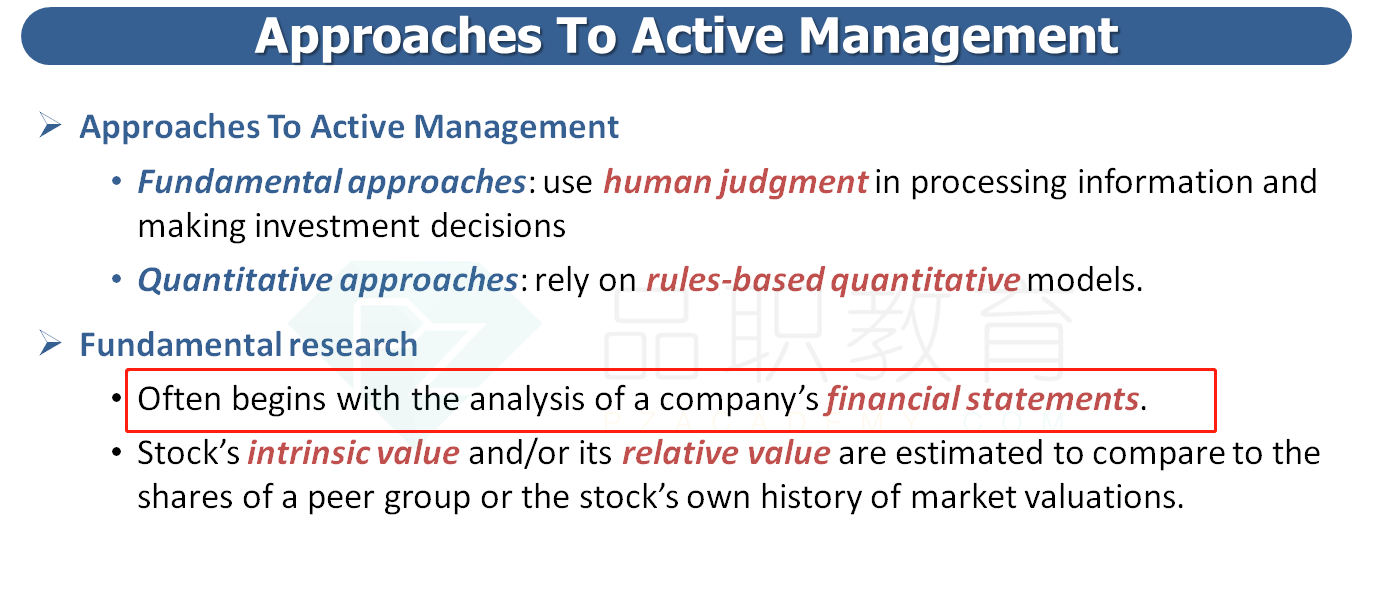

考点:Distinguishing fundamental and quantitative approaches

解析: 只有Buffet的投资方法是基于基本面分析,原因如下:

1、 该基金关注的公司的较少(只有研究65家公司)

2、 对每一家公司都进行深入研究,投资组合的创建过程基于基金经理的自由裁量和判断来决定。

3、 分析基于对财务报告的理解。此外,它们还将分析扩展到与基本面相关的其他领域,如公司品牌、竞争优势和治理。

基本面分析和bottom up分析能同时使用吗?我日觉得第一个选项是bottomup 不是fundamental