问题如下:

Which of Pereira’s statements about Miland Communications is most likely a warning sign of potential earnings manipulation?

选项:

A.The trend in inventory turnover

B.The trend in receivables turnover

C.The amount of net income relative to cash flow from operations

解释:

C is correct.

Net income being greater than cash flow from operations is a warning sign that the firm may be using aggressive accrual accounting policies that shift current expenses to future periods. Decreasing, not increasing, inventory turnover could suggest inventory obsolescence problems that should be recognized. Decreasing, not increasing, receivables turnover could suggest that some revenues are fictitious or recorded prematurely or that the allowance for doubtful accounts is insufficient.

解析:NI比CFO大,有可能是企业使用了激进的会计方法,推迟确认费用或者提前确认收入。Inventory turnover降低(而不是增加),说明相对于COGS,inventory变大了,有可能存在存货过时卖不掉的问题。Receivable turnover降低(而不是增加),说明相对于sales,A/R变大了,可能表明存在虚假收入或者提前确认收入,或者坏账准备不足的问题。

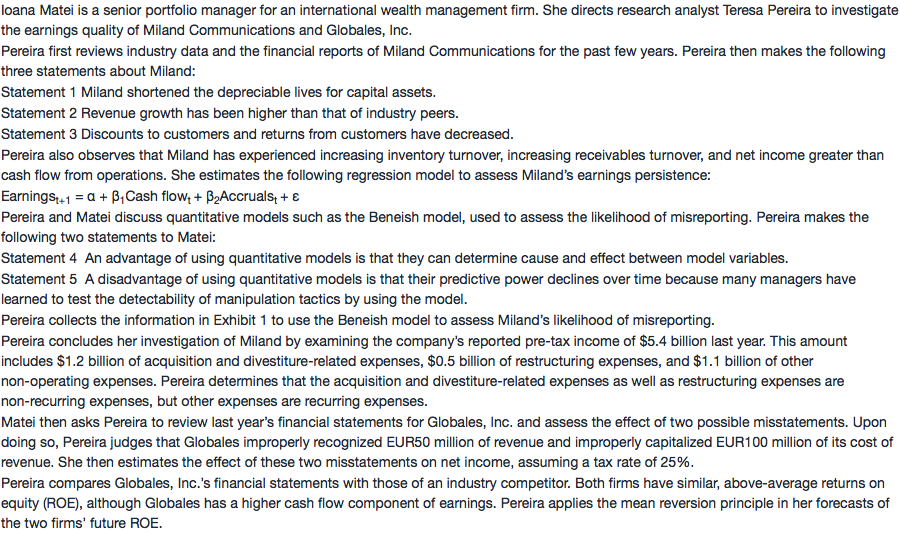

老师想请教一下,解释里面说 “Inventory turnover降低(而不是增加),说明相对于COGS,inventory变大了,有可能存在存货过时卖不掉的问题。(但题目里面说的是Miland has experienced increasing inventory turnover)

Receivable turnover降低(而不是增加),说明相对于sales,A/R变大了,可能表明存在虚假收入或者提前确认收入,或者坏账准备不足的问题。”(但是题目里面说的是 increasing receivables turnover)

解释是不是有问题,题目改过么?