问题如下:

Which of Winslow’s statements about carry trades is correct?

选项:

A. Statement I

B. Statement II

C. Statement III

解释:

A is correct.

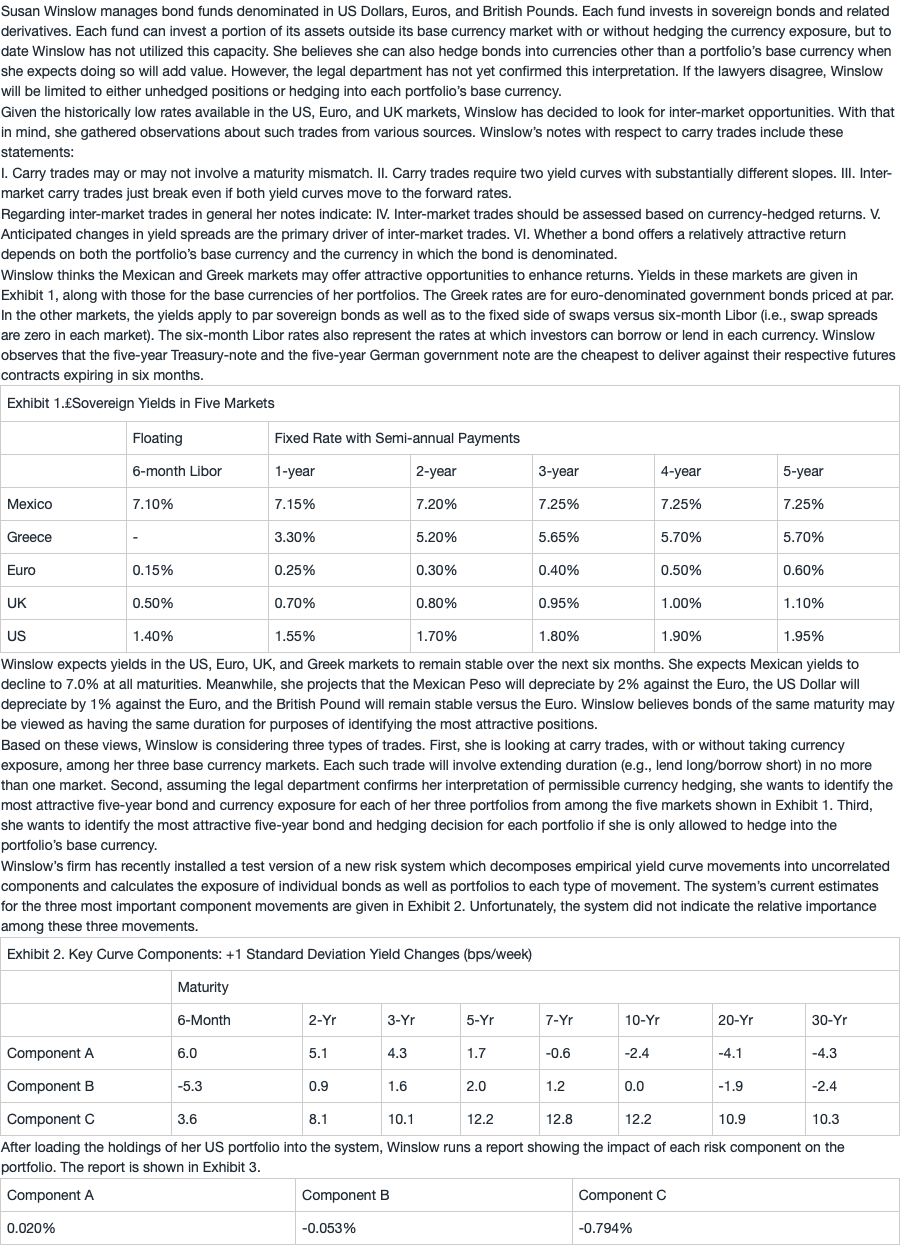

Carry trades may or may not involve maturity mis-matches. Intra-market carry trades typically do involve different maturities, but inter-market carry trades frequently do not, especially if the currency is not hedged.

B is incorrect. Carry trades may involve only one yield curve, as is the case for intra-market trades. In addition, if two curves are involved they need not have different slopes provided there is a difference in the level of yields between markets.

C is incorrect. Inter-market carry trades do not, in general, break even if each yield curve goes to its forward rates. Intra-market trades will break even if the curve goes to the forward rates because, by construction of the forward rates, all points on the curve will earn the "first-period" rate (that is, the rate for the holding period being considered). Inter-market trades need not break even unless the "first-period" rate is the same in the two markets. If the currency exposure is not hedged, then breaking even also requires that there be no change in the currency exchange rate.

為什麼C選項不對呢?Inter-market carry trade不是才會受到匯率跟forward rate的影響嗎?為什麼反而改成infra market就對了呢?