问题如下:

Suppose that the yield curve is upward sloping. Which of the following statements is true?

选项:

A.The forward rate yield curve is above the zero-coupon yield curve, which is above the coupon-bearing bond yield curve.

B.The forward rate yield curve is above the coupon-bearing bond yield curve, which is above the zero-coupon yield curve.

C.The coupon-bearing bond yield curve is above the zero-coupon yield curve, which is above the forward rate yield curve.

D.The coupon-bearing bond yield curve is above the forward rate yield curve, which is above the zero-coupon yield curve.

解释:

ANSWER: A

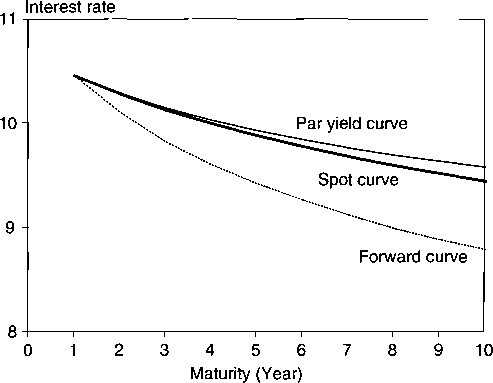

See Figures below:

The coupon yield curve is an average of the spot, zero-coupon curve; hence it has to lie below the spot curve when it is upward sloping. The forward curve can be interpreted as the spot curve plus the slope of the spot curve. If the latter is upward sloping, the forward curve has to be above the spot curve.

为什么upwarding的时候Par-rate要小于Spot Rate