问题如下:

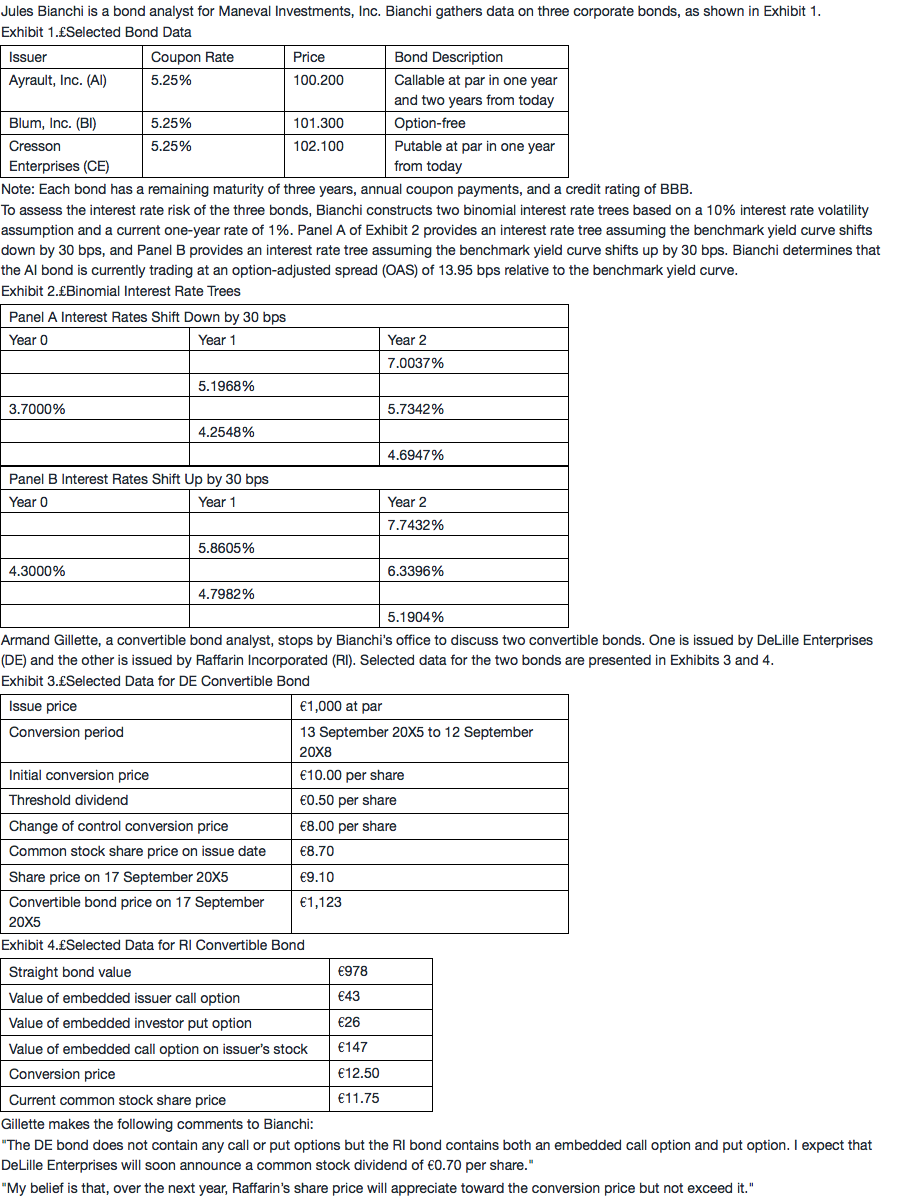

Based on Exhibit 4 and Gillette’s forecast regarding Raffarin’s share price, the return on the RI bond over the next year is most likely to be:

选项:

A.lower than the return on Raffarin’s common shares.

B.the same as the return on Raffarin’s common shares.

C.higher than the return on Raffarin’s common shares.

解释:

A is correct.

Over the next year, Gillette believes that Raffarin’s share price will continue to increase towards the conversion price but not exceed it. If Gillette’s forecast becomes true, the return on the RI bond will increase but at a lower rate than the increase in Raffarin’s share price because the conversion price is not expected to be reached.

老师如果这道题是股票价格下降,并远离conversion price,那是不是可转债的return就要大于stock price return了?因为这时候的可转债的return基本可以当做是straight bond的价格变化,变化很小,可以认为股票下跌的要多于这个变化,就像这道题一样,对吗?