问题如下:

PZ Co. is a multinational corporation that complies with IFRS and uses RMB as presentation currency. PZ has a subsidiary H&L, which is located in the US and uses US dollar (USD) as functional currency. H&L’s revenue for 2017 is USD90 million.

The amount that PZ Co. should include in its 31 December 2017 revenue from H&L is closest to:

选项:

A. RMB6.3 million.

B. RMB7.2 million.

C. RMB8.0 million.

解释:

A is correct.

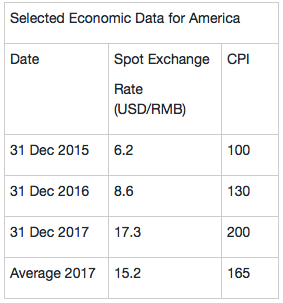

H&L公司经营所在地经历了恶性通货膨胀,PZ公司遵循IFRS,应该先restate H&L公司的revenue,然后再用current exchange rate转换为RMB之后合并报表。

USD90million×(200/165) =USD109.1million

USD 109.1 million/17.3=RMB6.3million

看了解析我知道了在根据inflation调整完H&L revenue之后应该用current rate进行准换,是因为200/165已经考虑了全年平均的影响! 那么如果是资产负债表的项目调整inflation就是200/130,没有考虑全年平均啊,请问用什么汇率?