问题如下:

Which of the following pairs of weights would be used to achieve the highest Sharpe ratio and optimal amount of active risk through combining the Indigo Fund and benchmark portfolio, respectively?

选项:

A.1.014 on Indigo and –0.014 on the benchmark

B.1.450 on Indigo and –0.450 on the benchmark

C.1.500 on Indigo and –0.500 on the benchmark

解释:

A is correct.

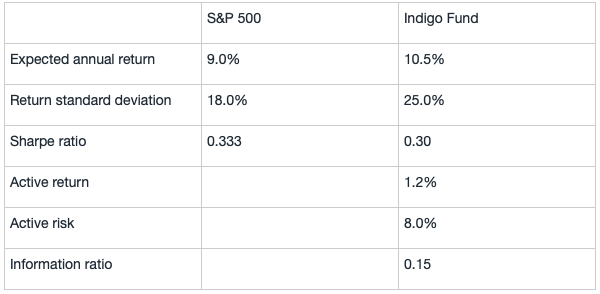

The optimal amount of active risk is:

The weight on the active portfolio (Indigo) would be 8.11%/8.0% = 1.014 and the weight on the benchmark portfolio would be 1 – 1.014 = – 0.014.

考点:Optimal amount of active risk

解析:Optimal amount of active risk

Indigo Fund现在的active risk是8%,为了使active risk达到最优水平,就将Indigo Fund与benchmark再做组合,形成active risk最优的combined fund。

假设Indigo Fund的权重为c, 那么

因此,benchmark的权重为1-1.014=-0.014

此题为什么不能通过最大的sharp ratio求解权重的,最大的sharp ratio是0.365。rf=0.03,这样算出来的权重为啥和答案不一致了?『0.105x+(1-x )0.09-0.03 』/0.25x+(1-x)0.18=0.365这样算出来的权重x为啥不对?