问题如下:

The following statements are about means tomitigate the risk of a run by short-term creditors for dealer banks, which of the following statements is NOT correct?

选项:

A. A dealer bank can mitigatethe risk of a loss of liquidity through a run by short-term creditors by establishinglines of bank credit

B. A dealer bank can mitigate the risk of a loss ofliquidity through a run by short-term creditors by dedicating a buffer stock of cash and liquid securities for emergencyliquidity needs.

C. A dealer bank can mitigate the risk of a lossof liquidity through a run by short-term creditors by Laddering the maturities of its liabilities so that only a smallfraction of its debt needs to be refinanced within a short period of time.

D. Dealer banks cannot have access to secured financing from central bankfacilities, thus it cannot help dealer banks to mitigate the risk of a run byshort-term creditors.

解释:

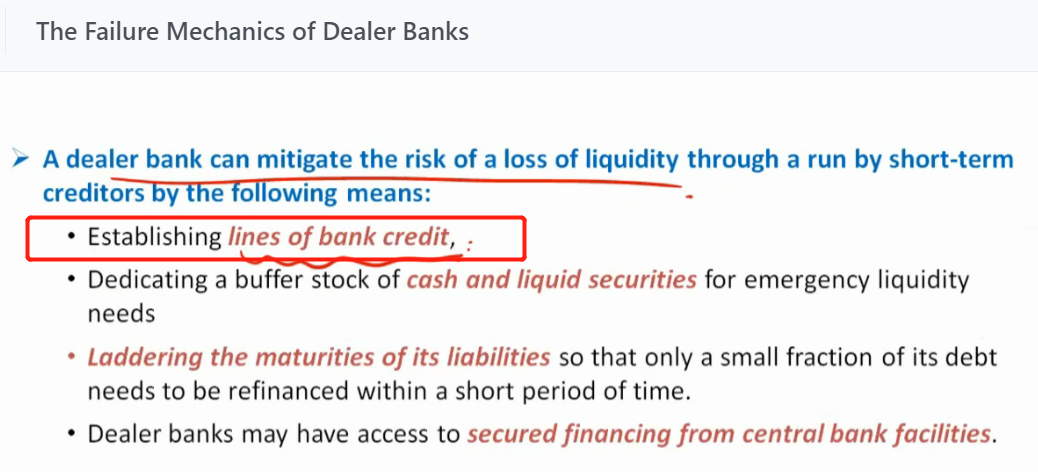

考点:对The Failure Mechanics of Dealer Banks的理解

答案:D选项表述错误,本题选D

解析:

Dealer bank可以通过从央行获得流动性。

Dealer bank可以通过以下4种方式缓解流动性危机:

1、Establishinglines of bank credit.

2、Dedicating abuffer stock of cash and liquid securities for emergency liquidity needs.

3、Laddering thematurities of its liabilities so that only a small fraction of its debt needsto be refinanced within a short period of time.

4、Dealer banks mayhave access to secured financing from central bank facilities.

lines of bank credit 指的是啥啊?