问题如下:

1. Based on the Modigliani and Miller (MM) propositions with corporate taxes, Aquarius’s WACC is closest to:

选项:

A.3.38%.

B.7.87%.

C.11.25%.

解释:

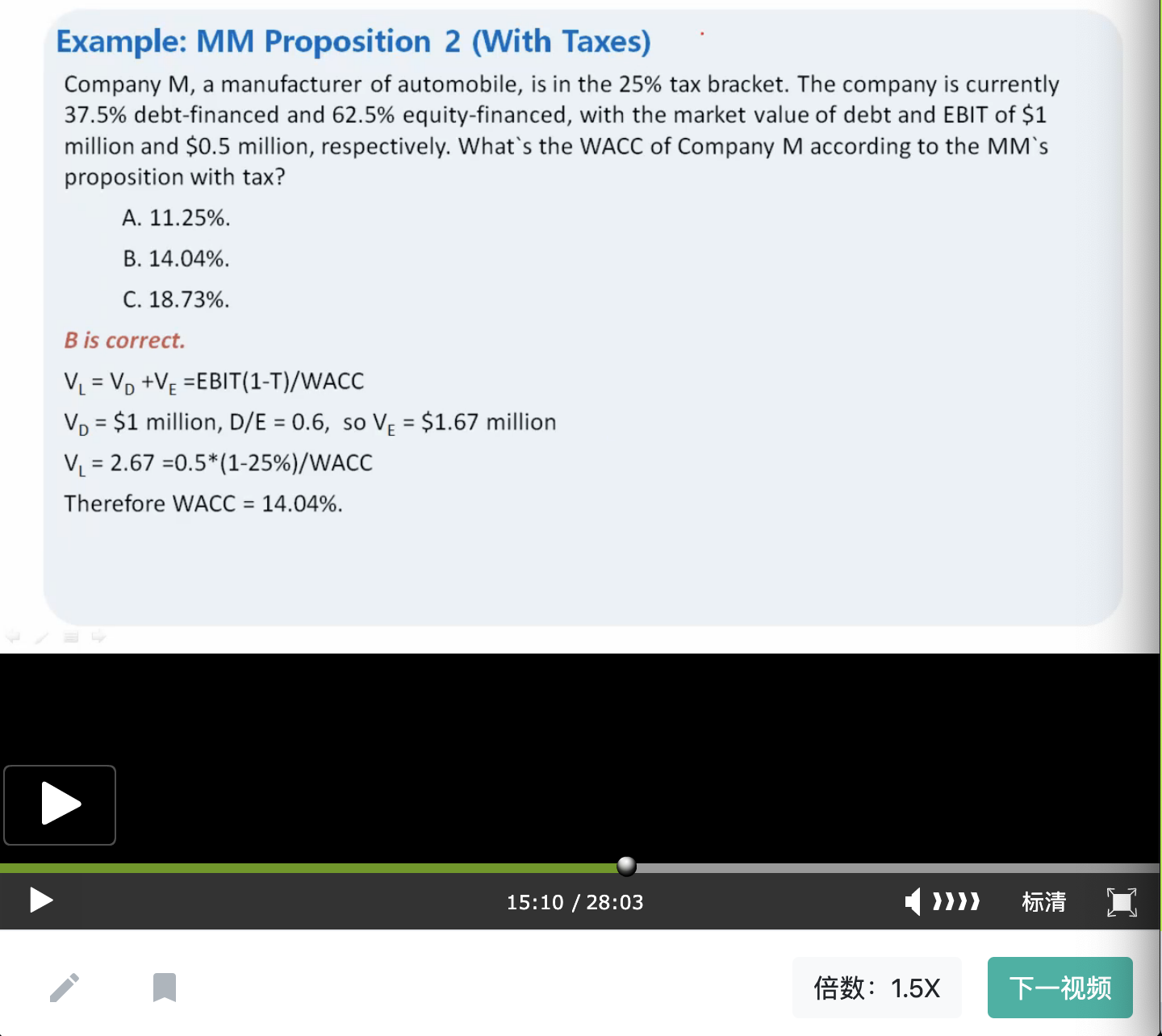

B is correct.

Because D/E = 0.60 and D = £2m, then E = £2m/(0.60) = £3,333,333

So, Value of company ( ) = D + E = £2,000,000 + £3,333,333 = £5,333,333

So,

老师好 不是 VL = EBIR ( 1-T) / WACC 是只有在没有debt 的时候才用的吗? 这题里不是有DEBT 为什么不用V. = VU + debt *t or interest / rd + (Ebit -i)*(1-t)/re or ebir( 1-t)/r0=D*T这些公式? 谢谢。