问题如下:

3. Using Withers’s assumptions for the H-model and the basic two-stage dividend discount model, the forecasted Ukon stock price at the end of the year 2021 for the H-model should be:

选项:

A.lower than the basic two-stage model.

B.the same as the basic two-stage model.

C.higher than the basic two-stage model

解释:

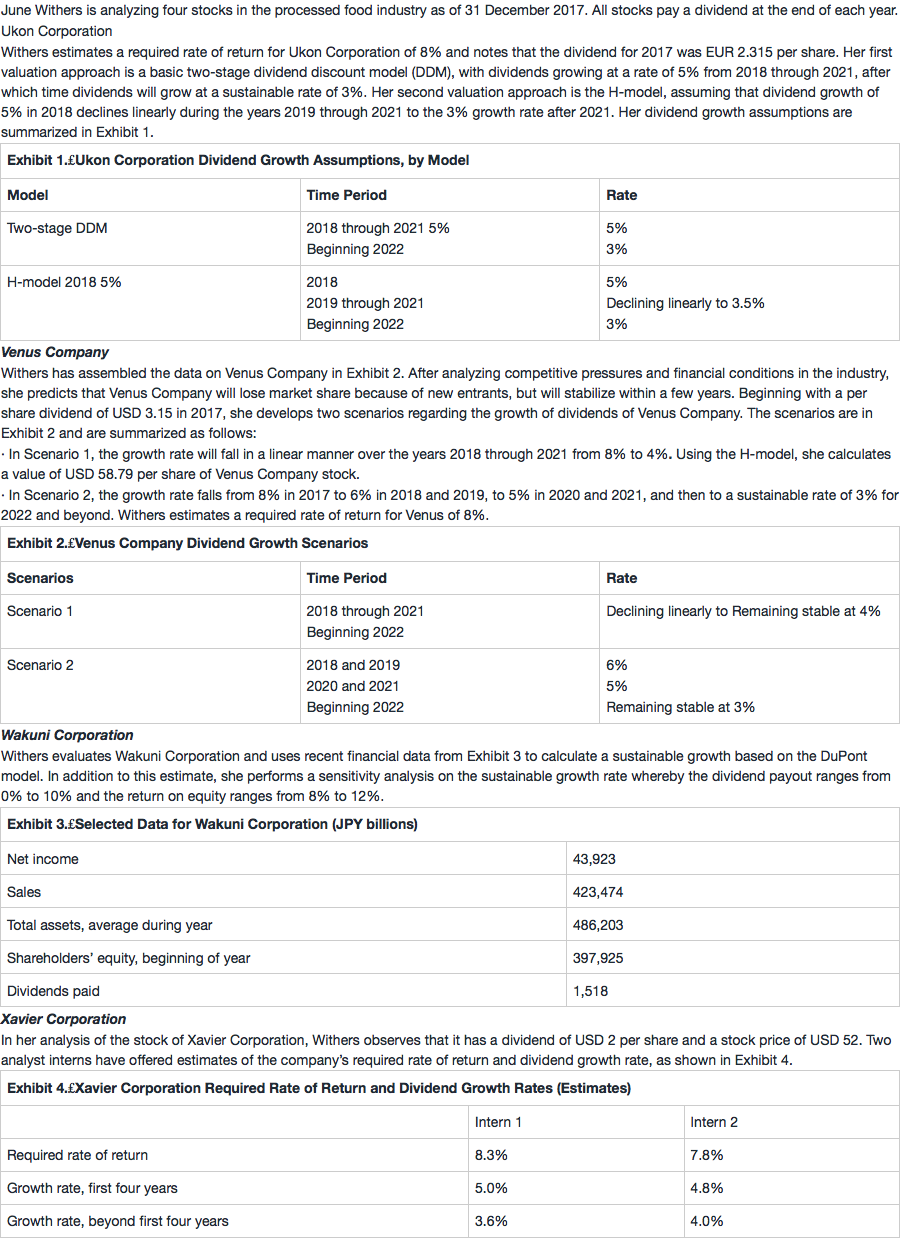

A is correct. During the first stage, the basic two-stage model has higher (i.e., 5%) growth than the H-model, in which growth is declining linearly from 5.0% to 3.5%. Higher growth rates result in higher forecasted dividends and stock prices at the beginning of the sustained growth phase. Because the long-term dividend growth rates are the same for both models, the difference in forecasted stock price arises from growth rate differences in the first stage.

Therefore, the dividend at the end of the first stage will be lower for the H-model than for the basic two-stage DDM, and the terminal value will be lower in the H-model than in the two-stage model. Specifically, the 2021 dividends will be

2.734 (i.e., 2.315 × 1.05 × 1.045 × 1.04 × 1.035) for the H-model versus 2.815 [i.e., 2.315 × (1.05)4] for the basic two-stage DDM.

根据已知条件:Her second valuation approach is the H-model, assuming that dividend growth of 5% in 2018 declines linearly during the years 2019 through 2021 to the 3% growth rate after 2021. Her dividend growth assumptions are summarized in Exhibit 1.

直接用H-MODEL算VALUE,请问在增速下降阶段的那部分公式D0*(gHigh-gLow)*T/2再除以(Re-gLow),这个T对应是3年还是4年?