问题如下:

John Tomb is an investment advisor at an asset management firm. He is developing an asset allocation for James Youngmall, a client of the firm. Tomb considers two possible allocations for Youngmall. Allocation A consists of four asset classes: cash, US bonds, US equities, and global equities. Allocation B includes these same four asset classes, as well as global bonds. Youngmall has a relatively low risk tolerance with a risk aversion coefficient (λ) of 7. Tomb runs mean–variance optimization (MVO) to maximize the following utility function to determine the preferred allocation for Youngmall:

Um= E(R)- 0.005λσm2

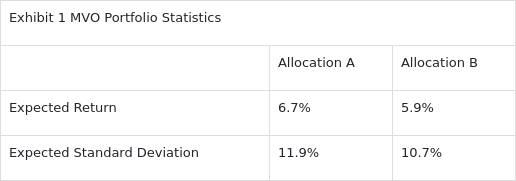

The resulting MVO statistics for the two asset allocations are presented in Exhibit 1.

Determine which allocation in Exhibit 1 Tomb should recommend to Youngmall. Justify your response.

解释:

Tomb should

recommend Allocation B.

The expected utility of Allocation B is 1.89%, which is

higher than Allocation A’s expected utility of 1.74%.

MVO provides a framework to determine how much to

allocate to each asset class or to create the optimal asset mix. The given

objective function is:

Um= E(R)- 0.005λσm2

Using the given objective

function and the expected returns and expected standard deviations for Allocations

A and B, the expected utilities (certainty equivalent returns) for the two

allocations are calculated as:

Allocation A: 6.7% – 0.005 (7) (11.9%)2 =

1.74%

Allocation B: 5.9% – 0.005 (7) (10.7%)2 =

1.89%

Therefore, Tomb should recommend Allocation B because it

results in higher expected utility than Allocation A.