问题如下:

The unbiased expectations theory assumes investors are:

选项:

A.risk averse.

risk neutral.

risk seeking.

解释:

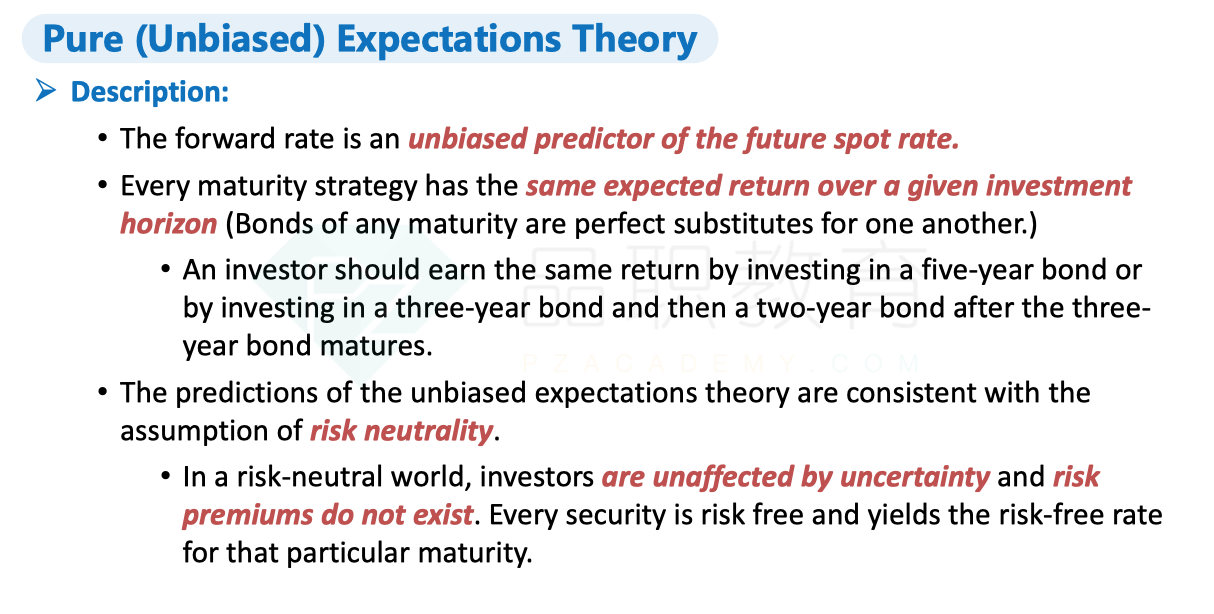

B is correct. The unbiased expectations theory asserts that different maturity strategies, such as rollover, maturity matching, and riding the yield curve, have the same expected return. By definition, a risk-neutral party is indifferent about choices with equal expected payoffs, even if one choice is riskier. Thus, the predictions of the theory are consistent with the existence of risk-neutral investors.

关于该知识点,讲义里说same expected return over a given investment horizon,题目解释里说different maturity strategies。请问,应该理解为投资期一致、return相同,还是投资期不一致、return相同?

同学你好,请看这段详细讲义。框架图只摘取的红色的部分。它其实的意思是,做一个五年期的投资,直接投5年和先投2年再投3年没有区别的意思。所以题目的解释和强化班讲义并没有矛盾。

同学你好,请看这段详细讲义。框架图只摘取的红色的部分。它其实的意思是,做一个五年期的投资,直接投5年和先投2年再投3年没有区别的意思。所以题目的解释和强化班讲义并没有矛盾。