问题如下:

After adjusting the Globales, Inc. income statement for the two possible misstatements, the decline in net income is closest to:

选项:

A.EUR37.5 million.

B.EUR112.5 million.

C.EUR150.0 million.

解释:

B is correct.

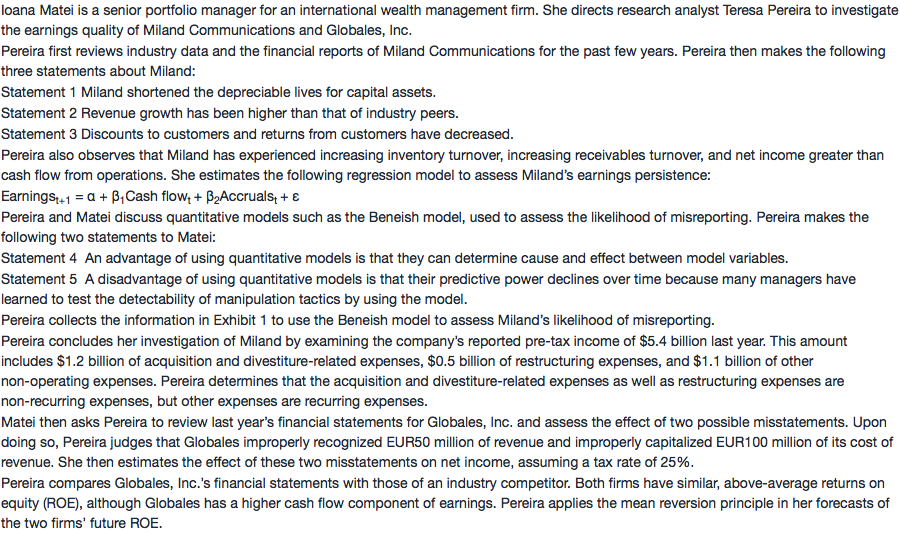

The correction of the revenue misstatement would result in lower revenue by EUR50 million, and the correction of the cost of revenue misstatement would result in higher cost of revenue by EUR100 million. The result is a reduction in pre-tax income of EUR150 million. Applying a tax rate of 25%, the reduction in net income would be 150 × (1 – 0.25) = EUR112.5 million.

解析:分析师认为G公司确认了不应该确认的收入50 million,修改后的revenue会降低50 million。还有本应该确认为cost of revenue的100 million被资本化了,修改后的cost of revenue会增加100million,这两项的修改总共会降低税前收入150 million,扣税后为:150*(1-25%)=112.5 million,因此NI会降低112.5 million。

之前的费用资本化,每年应该也会有一笔摊销的费用吧?这个不要考虑进去么?