问题如下:

A four-year corporate bond with a 7% coupon has a Z-spread of 200 bps. Assume a flat yield curve with an interest rate for all maturities of 5% and annual compounding. The bond will most likely sell:

选项:

A. close to par.

B. at a premium to par.

C. at a discount to par.

解释:

A is correct.

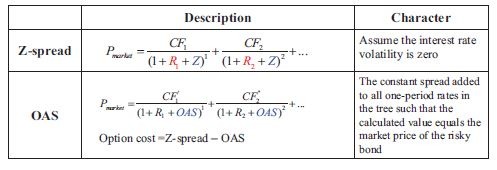

The 200bps Z-spread can be added to the 5% rates from the yield curve to price the bond. The resulting 7% discount rate will be the same for all of the bond's cash-flows, since the yield curve is flat. A 7% coupon bond yielding 7% will be priced at par.

请问z spread是否等于Par Rate-Implied Spot Rate?