问题如下:

Which of Winslow’s statements about inter-market trades is incorrect?

选项:

A. Statement IV

B. Statement V

C. Statement VI

解释:

C is correct.

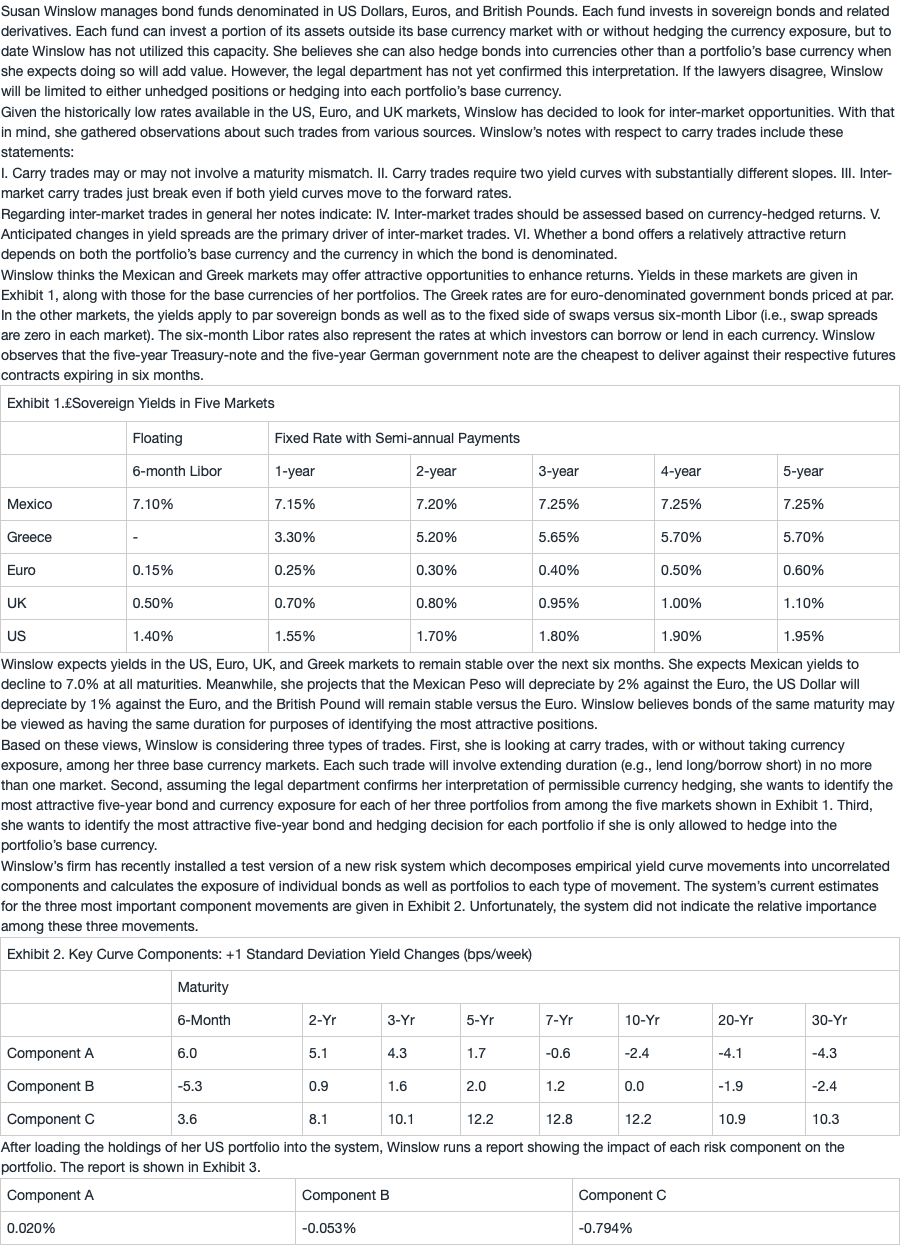

Winslow’s Statement VI is incorrect. Due to covered interest arbitrage, the relative attractiveness of bonds does not depend on the currency into which they are hedged for comparison. Hence, the ranking of bonds does not depend on the base currency of the portfolio.

A is incorrect because Winslow’s Statement IV is correct. Inter-market trades should be assessed on the basis of returns hedged into a common currency. Doing so ensures that they are comparable. Neither local currency returns nor unhedged returns are comparable across markets because they involve different currency exposures/risks.

B is incorrect because Winslow’s Statement V is correct. The primary driver of inter-market trades is anticipated changes in yield differentials. Over horizons most relevant for active bond management, the capital gains/losses arising from yield movements generally dominate the income component of return (i.e., carry) and rolling down the curve. Hence, expectations with respect to yield movements are the primary driver of inter-market trade decisions.

B项目的primary因素应该是两个吧,一个是利率差,一个是汇率?