问题如下:

6. If Alex Renteria is correct that the current price of Tasty Foods stock is its fair value, what is expected capital gains yield on the stock?

选项:

A. 3.87%.

B. 4.25%.

C. 5.30%.

解释:

A is correct.

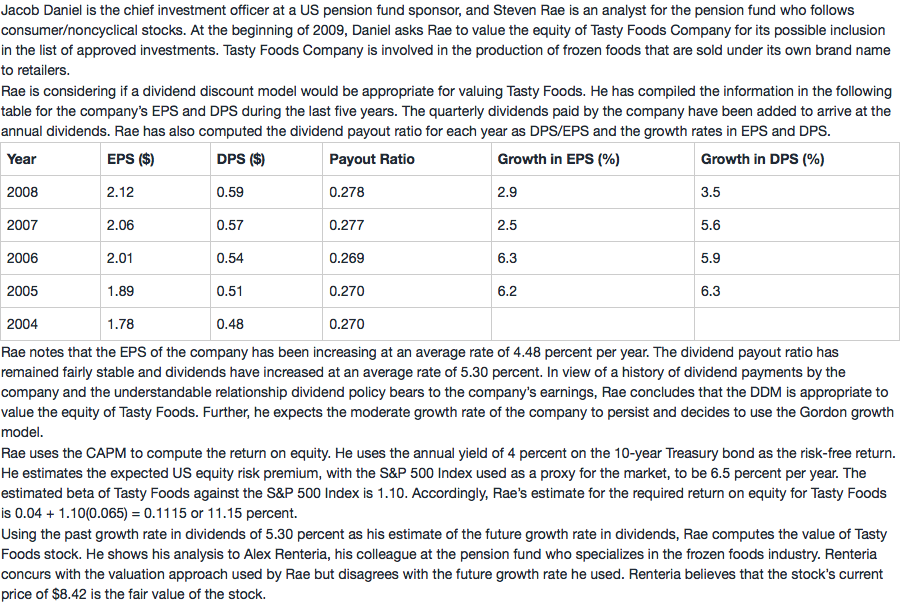

If the stock is fairly priced in the market as per the Gordon growth model, the stock price is expected to increase at g, the expected growth rate in dividends. The implied growth rate in dividends, if price is the fair value, is 3.87 percent. Therefore, the expected capital gains yield is 3.87 percent.

请问这一题,当P0=V0,Fairly Valued,E(r)=R(e)=CG yield + Div yield这个等式成立吗?成立的话,已知Re=11.15%,Div yield用0.59/8.42,算出来CG yield不对呢?