问题如下:

Based on Exhibit 4, Singh and Ho should conclude that under Scenario 2, shares of Bern are:

选项:

A.

undervalued.

B.

fairly valued.

C.

overvalued.

解释:

A is correct. The total market value of the firm is the sum of the debt, preferred stock, and common stock market values: 15,400 + 4,000 + 18,100 = 37,500 million.

WACC = [wd × rd(1 Tax rate)] + (wp × rp) + (we × re).

= [(15,400/37,500)(0.060)(1 0.269] + (4,000/37,500)(0.055) + (18,100/37,500)(0.11) = 7.70%.

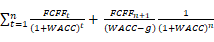

Under the assumption that Bern has a low growth rate because it did not receive regulatory approval for its new drugs, the value of Bern can be analyzed using a two-stage valuation model.

Company

value =

The terminal value at the end of Year 3 is TV3 = FCFF4/(WACC g4).

TV3 = 3,398.66/(0.0770 0.0075) = 48,921.38 million. The total value of operating assets = (3,040.37 + 2,865.42 + 2,700.53) + 48,921.38/(1 + 0.0770)3.

= 8,606.32 + 39,163.88

= 47,770.20 million.

Value of Bern’s common stock = Value of operating assets + Value of non-operating assets Market value of debt Preferred stock.

= 47,770.20 + 50.00 15,400 4,000

= 28,420.20 million.

Since the current market value of Bern’s common stock (18,100 million) is less than the estimated value (28,420.20 million), the shares are undervalued.

题目问的是share of bern公司高估还是低估,为什么不用FCFE折现与MV of common stock比较?