问题如下:

2. Based on Exhibit 1 and the note to Adesivo’s financial statements, the trailing P/E for Adesivo using underlying EPS is closest to:

选项:

A. 17.7.

B. 18.2.

C. 18.4.

解释:

C is correct. The EPS figure that Silveira should use is diluted trailing EPS of R$0.81, adjusted as follows:

1. Subtract the R$0.04 non-recurring legal gain.

2. Add R$0.03 for the non-recurring factory integration charge.

No adjustment needs to be made for the R$0.01 charge related to depreciation because it is a recurring charge.

Therefore, underlying trailing EPS = R$0.81 – R$0.04 + R$0.03 = R$0.80 and trailing P/E using underlying trailing EPS = R$14.72/R$0.80 = 18.4.

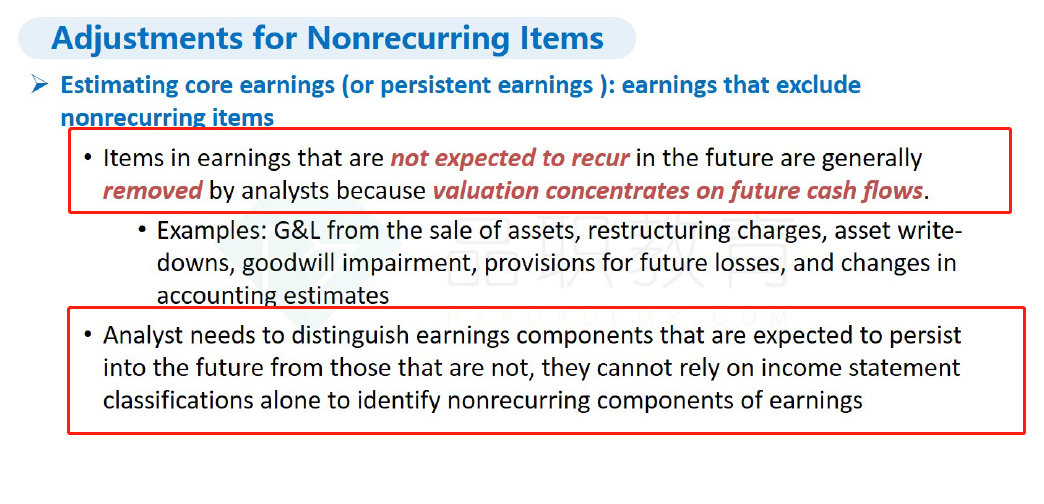

nonrecurring cost减掉可以理解,还有recurring cost 0.01为什么不加上?