问题如下:

3. Based on Exhibit 2, the price-to-book multiple for Centralino is closest to:

选项:

A. 2.0.

B. 2.2.

C. 2.5.

解释:

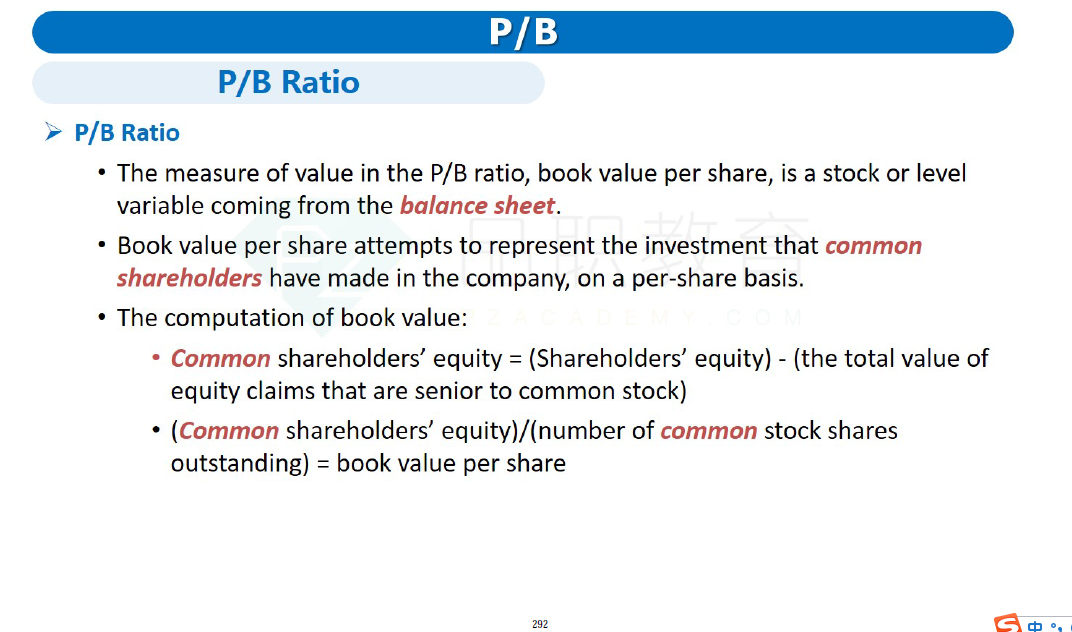

B is correct. Price to book is calculated as the current market price per share divided by book value per share. Book value per share is common shareholders’ equity divided by the number of common shares outstanding. Common shareholders’ equity is calculated as total shareholders’ equity minus the value of preferred stock

Thus:

Common shareholders’ equity = €1,027 – €80 = €947 million

Book value per share = €947 million/41.94 million = €22.58

Price-to-book ratio (P/B) for Centralino = €50/€22.58 = 2.2

还是不能理解P/B里的BV为什么不只考虑common stock,按照老师的讲解只要遇到P/B里的B就是Total equity-preferred stock嘛?