问题如下:

In Fund 3’s latest

quarterly report, Ap reads that Fund 3 implemented a new formal risk control

for its forecasting model that constrains the predicted return distribution so

that no more than 60% of the deviations from the mean are negative.

Which risk measure

does Fund 3’s new risk control explicitly constrain?

选项:

A.

Volatility

B.

Skewness

C.

Drawdown

解释:

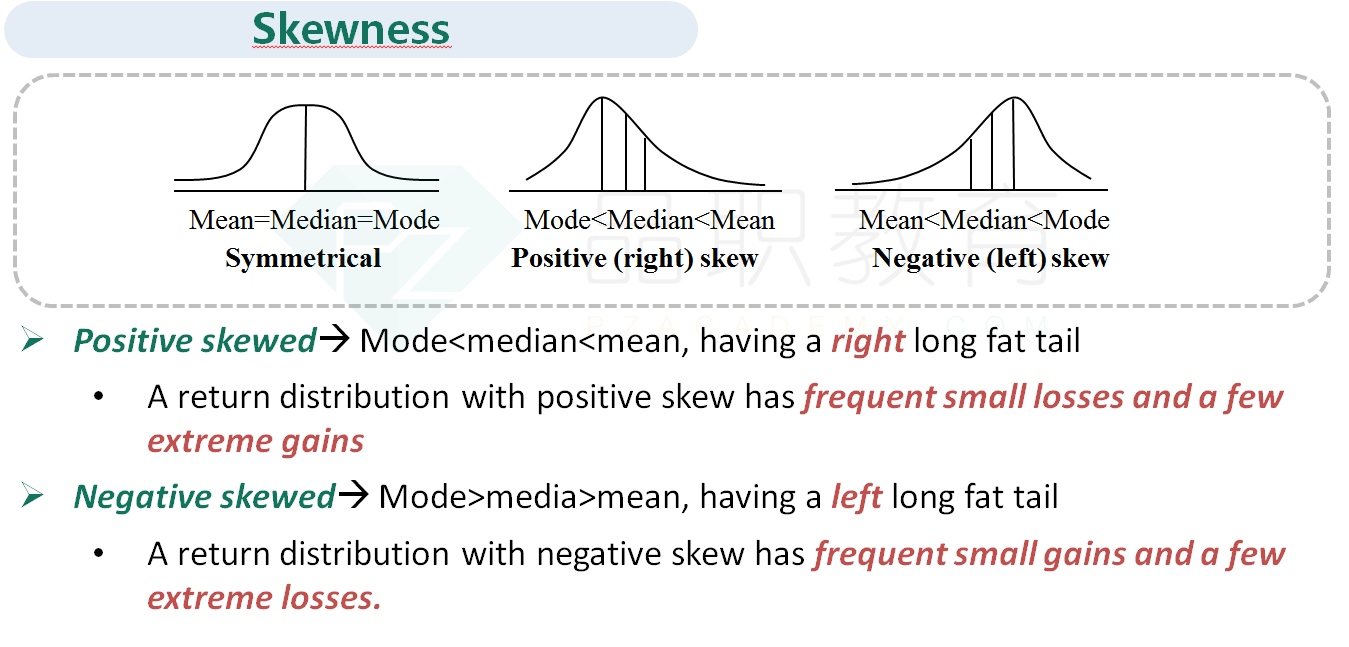

Skewness measures

the degree to which return expectations are non-normally distributed. If a

distribution is positively skewed, the mean of the distribution is greater than

its median—more than half of the deviations from the mean are negative and less

than half are positive—and the average magnitude of positive deviations is

larger than the average magnitude of negative deviations. Negative skew

indicates that that the mean of the distribution lies below its median, and the

average magnitude of negative deviations is larger than the average magnitude

of positive deviations. Fund 3’s new risk control constrains its model’s

predicted return distribution so that no more than 60% of the deviations from

the mean are negative. This is an explicit constraint on skewness.