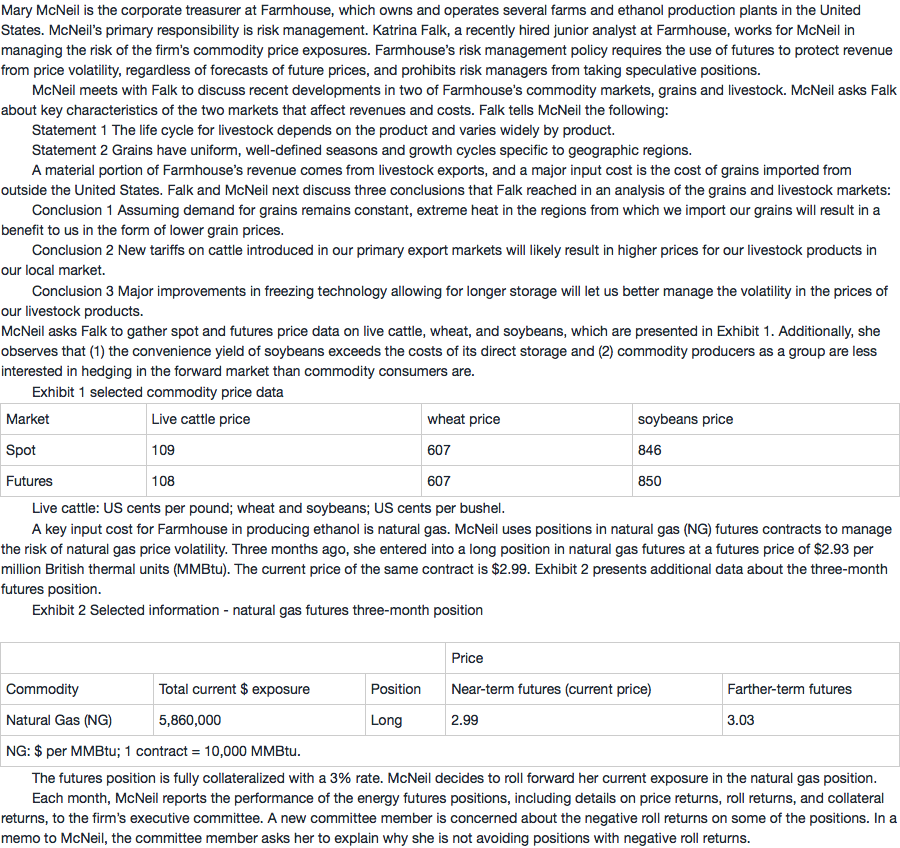

问题如下:

7. The most appropriate response to the new committee member’s question is that:

选项:

A.

roll returns are negatively correlated with price returns.

B.

such roll returns are the result of futures markets in backwardation.

C.

such positions may outperform other positions that have positive roll returns.

解释:

C is correct.

Investment positions are evaluated on the basis of total return, and the roll return is part of the total return. Even though negative roll return negatively affects the total return, this effect could be more than offset by positive price and collateral returns. Therefore, it is possible that positions with negative roll returns outperform positions with positive roll returns, depending on the price and collateral returns.