问题如下:

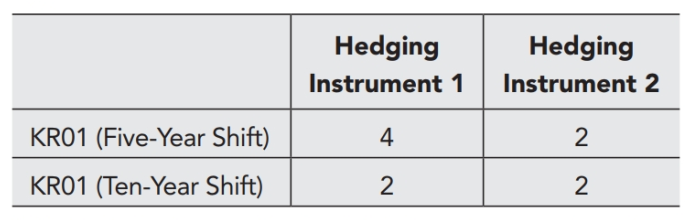

Two hedging instruments are available with the exposures shown in the following table. What positions in the instruments should be taken to zero out the exposure of the portfolio in the previous question to the five- and ten-year key rate shifts?

选项:

解释:

Suppose that X1 and X2 are the positions in the two hedging instruments. We require

4X1 + 2X2 + 12 = 0

2X1 + 2X2 + 8 = 0

The solution

to these equations is X1 =

−2 and X2 =

−2. We need to take a short position of two in each

hedging instrument.

老师您好,为什么要+12和+8呢?