问题如下:

The Barboa Fund can be best described as a fund segmented by:

选项:

A.size/style.

B.geography.

C.economic activity.

解释:

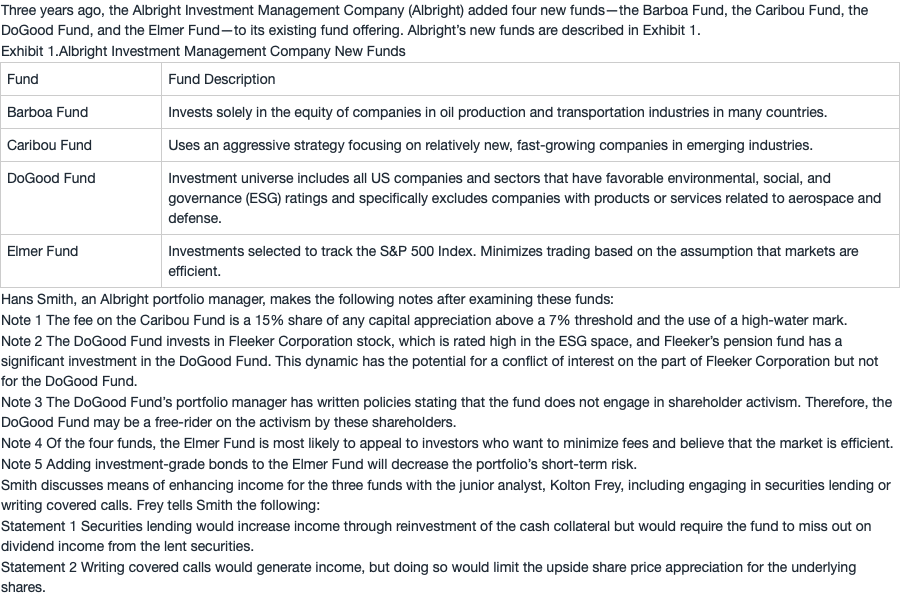

C is correct. The Barboa Fund invests solely in the equity of companies in the oil production and transportation industries in many countries. The fund’s description is consistent with the production-oriented approach, which groups companies that manufacture similar products or use similar inputs in their manufacturing processes.

A is incorrect because the fund description does not mention the firms’ size or style (i.e., value, growth, or blend). Size is typically measured by market capitalization and often categorized as large cap, mid-cap, or small cap. Style is typically classified as value, growth, or a blend of value and growth. In addition, style is often determined through a "scoring" system that incorporates multiple metrics or ratios, such as price-to-book ratios, price-to-earnings ratios, earnings growth, dividend yield, and book value growth. These metrics are then typically "scored" individually for each company, assigned certain weights, and then aggregated.

B is incorrect because the fund is invested across many countries, which indicates that the fund is not segmented by geography. Segmentation by geography is typically based upon the stage of countries’ macroeconomic development and wealth. Common geographic categories are developed markets, emerging markets, and frontier markets.

老师好,能否麻烦老师帮忙解释下答案解析中对于style那一部分?关于scoring system的解释,没有太明白。谢谢老师