问题如下:

Is it true that the expected payoff of the derivative can be discounted at the risk-free rate plus a risk premium?

选项:

A.

No, because a conbination of a derivative and the underlying can produce a risk-free asset.

B.

Yes, because most investors are risk averse, they require a risk premium.

C.

No, because most investors are risk neutrality, they do not need a premium.

解释:

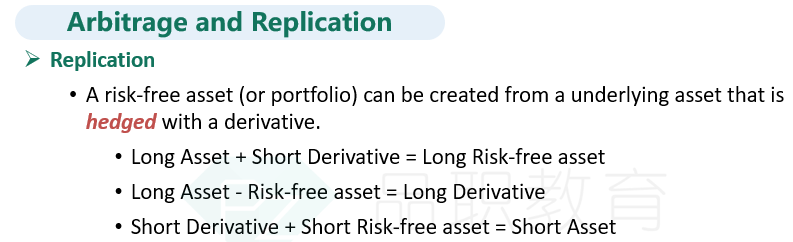

A is correct. The expected payoff of the derivative can be discounted at the risk-free rate, because a derivative can be combined with an asset to produce a risk-free position and the derivative price can be obtained by assuming that the investor is risk neutral.

C is incorrect because most investors are risk averse, however the investor's risk aversion does not affect the derivative price.

老师,我不太能理解这道题的解释,太抽象了,可以举例子吗?比如用mbs作为一个衍生品举例,为什么未来的pay off要用无风险利率来折现?之前不是说需要加一个信用风险溢价spread吗?