问题如下:

6. Based on Byron’s forecast, NinMount’s 2009 total asset turnover ratio on beginning assets under the equity method is most likely:

选项:

A.

lower than if the results are reported using consolidation.

B.

the same as if the results are reported using consolidation.

C.

higher than if the results are reported using consolidation.

解释:

A is correct.

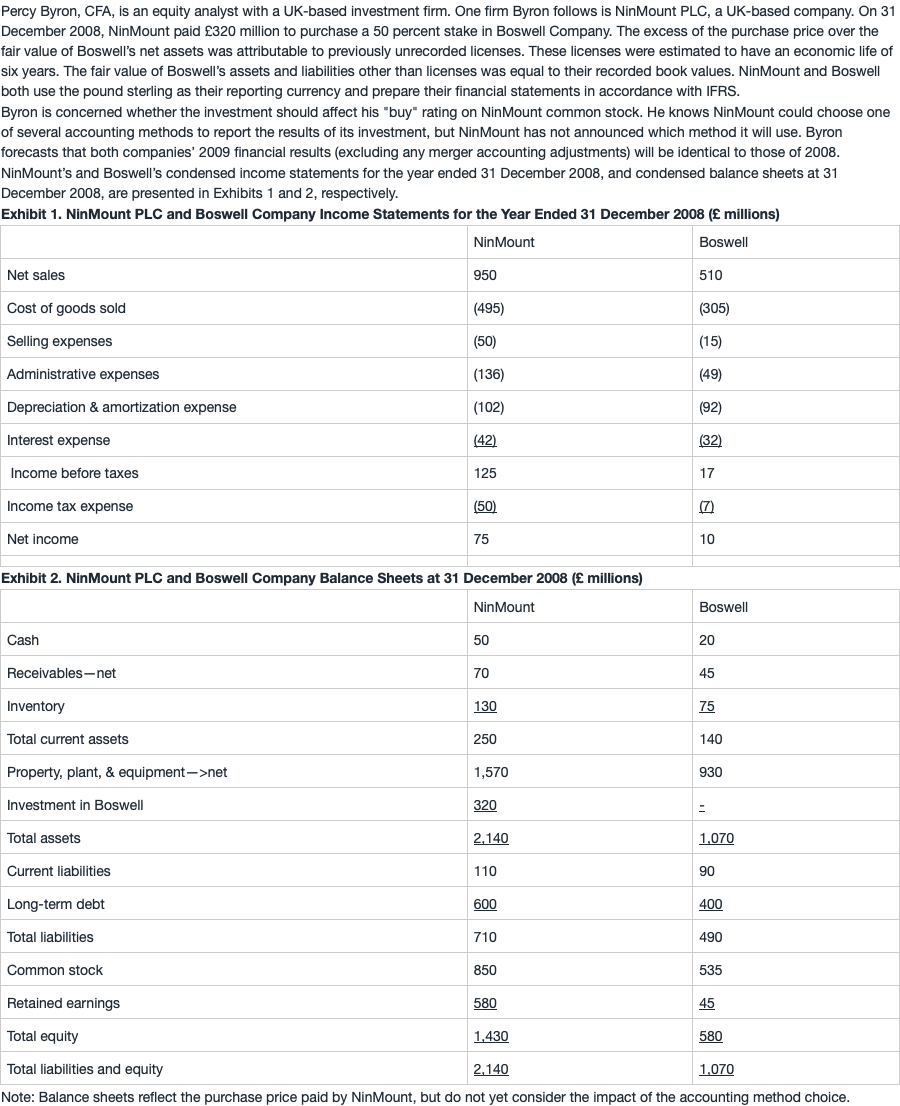

Using the equity method, Total asset turnover = Net sales/Beginning total assets = £950/£2,140 = 0.444. Total asset turnover on beginning assets using consolidation = £1,460/£2,950 = 0.495. Under consolidation, Assets = £2,140 -320 + 1,070 + 60 = £2,950. Therefore, total asset turnover is lowest using the equity method.

考点 : 不同的合并会计报表方法对 会计比率的影响。

解析 :

Total asset turnover = Net sales/Beginning total assets

对于equity method来说,Total asset turnover = Net sales/Beginning total assets = £950/£2,140 = 0.444

对于consolidation method来说,Assets = £2,140 -320 + 1,070 + 60 = £2,950,且需合并收入,Total asset turnover = £1,460/£2,950 = 0.495

在equity method下,total asset turnover 更低。

对于consolidation method下asset的计算特别说明一下:

-320是因为在合并里需要扣除母公司个报中的investment这一项,因为consolidation需要全额合并子公司的资产和负债,这就相当于合并了子公司的权益。而investment即是对子公司权益的投资,如果在合并时不扣除investment这一项,就会重复记账。

+60是因为子公司有一项未记账的资产,在合并时需要加回。

请问unrecorded license的计算是在按照full goodwill的方法算吗?如果是的话为什么呢?还是不太理解为什么要加回60。