问题如下:

Holding an asset and buying a put on that asset is equivalent to:

选项:

A.initiating a fiduciary call.

B.buying a risk- free zero- coupon bond and selling a call option.

C.selling a risk- free zero- coupon bond and buying a call option.

解释:

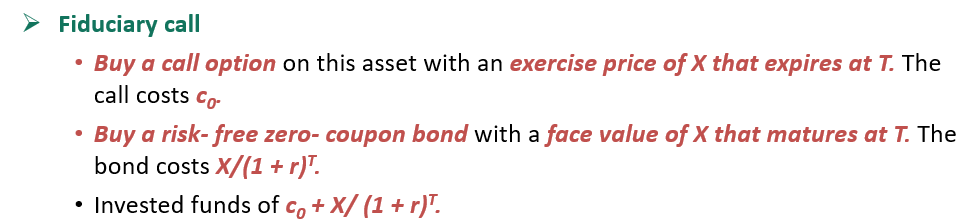

A is correct. Under put–call parity, initiating a fiduciary call (buying a call option on an asset that expires at time T together with a risk- free zero- coupon bond that also expires at time T) is equivalent to holding the same asset and initiating a protective put on it (buying a put option with an exercise price of X that can be used to sell the asset for X at time T).

Reading

请解释这道题目