问题如下:

The market value of equity for a company can be calculated as enterprise value:

选项:

A. minus market value of debt, preferred stock, and short-term investments.

B. plus market value of debt and preferred stock minus short-term investments.

C. minus market value of debt and preferred stock plus short-term investments.

解释:

C is correct.

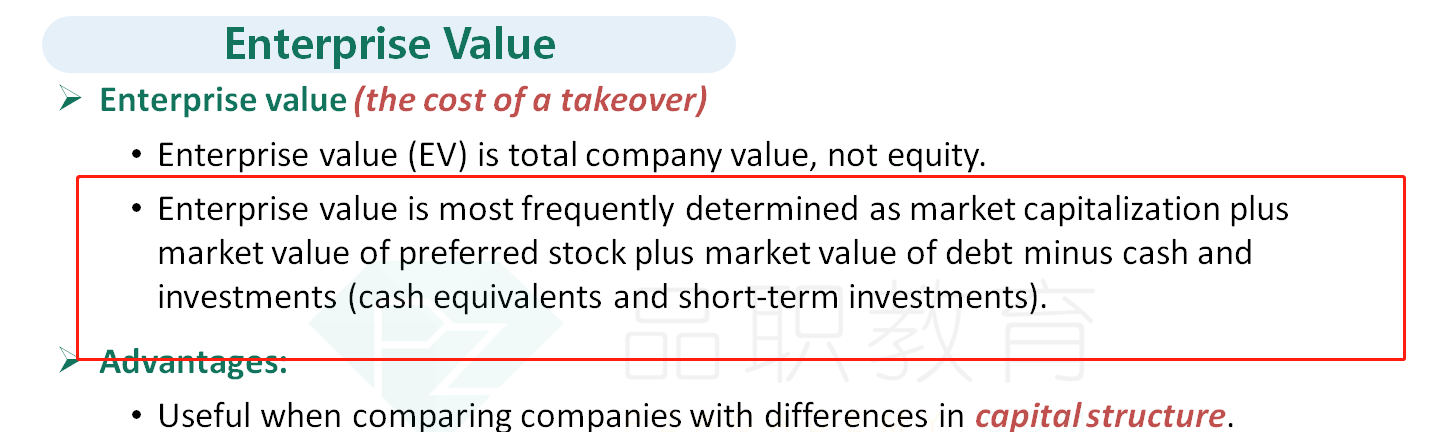

Enterprise value is calculated as the market value of equity plus the market value of debt and preferred stock minus short-term investments. Therefore, the market value of equity is enterprise value minus the market value of debt and preferred stock plus short-term investments.

从理解上来说,为什么要减掉现金和短期投资呢?这个知识点在讲义哪部分呀