问题如下:

Hsu also selects the two floating-rate bonds issued by Varlep, plc given in Exhibit below. These bonds have a maturity of three years and the same credit rating.

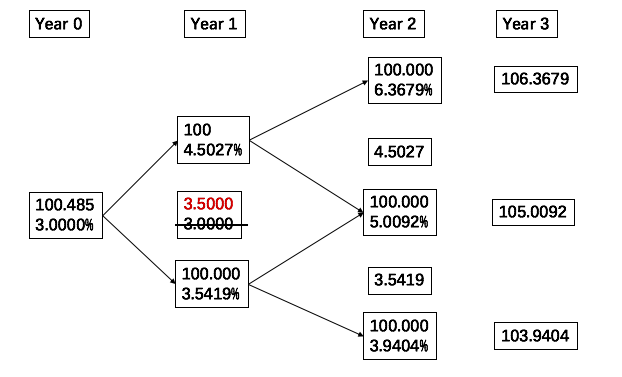

To value Varlep’s bonds, Hsu constructs the binomial interest rate tree provided below:

The value of Bond #8 is closest to:

选项:

A.98.116% of par.

B.100.000% of par.

C.100.485% of par.

解释:

C is correct.

考点:使用二叉树对浮动利率债券进行估值

解析:

题干要求是对Bond 8进行估值,注意Bond 8是一个具有利率底(Floored at 3.50%)的浮动利率债券,当Coupon低于3.50%时,Coupon需要调整到3.50.

如下图所示,Year 1由浮动利率决定的Coupon为3.00,但是由于存在利率底,所以取不到3.00,需要将Coupon调整到3.50。

这道题可以通过选项来用排除法做吗?因为year1的coupon rate大于折现率,后面的又都是100。因此,可以判断出V0应该会大于100。这个思路对吗