问题如下:

3. Rae considers a security trading within a band of ±10 percent of his estimate of intrinsic value to be within a "fair value range." By that criterion, the stock of Tasty Foods is:

选项:

A.undervalued.

B.fairly valued.

C.Overvalued.

解释:

A is correct.

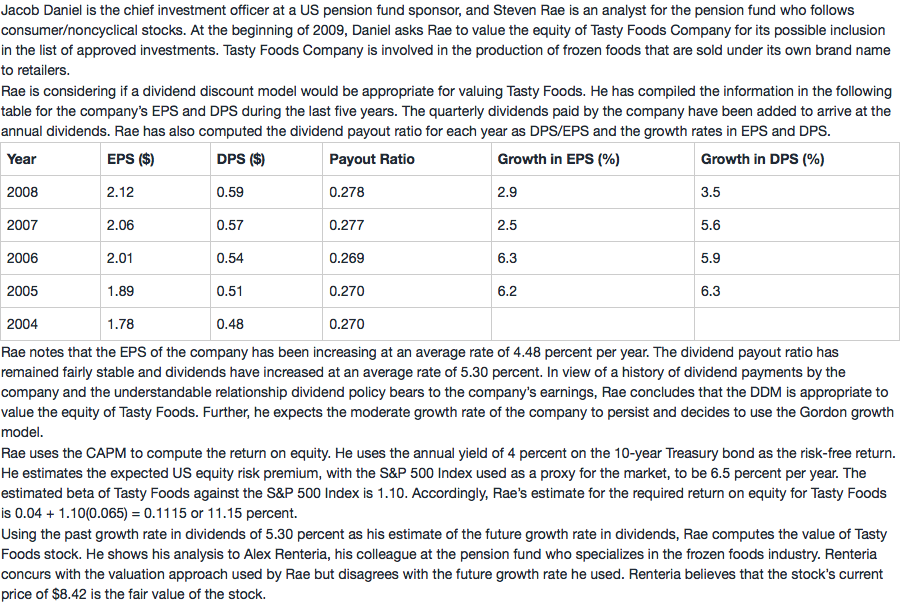

Rae’s estimate of the intrinsic value is $10.62. So, the band Rae is looking at is $10.62 ± 0.10($10.62), which runs from $10.62 + $1.06 = $11.68 on the upside to $10.62 -$1.06 = $9.56 on the downside. Because $8.42 is below $9.56, Rae would consider Tasty Foods to be undervalued.

请问1.06是从哪里算出的,之前算出的P0=10.62,band是0.1. 我的理解是,upside是10.72,downside是10.52。

谢谢老师