问题如下:

An investor should prefer a pooled investment vehicle to a separately managed account when she:

选项:

A.is cost sensitive.

focuses on tax efficiency.

requires clear legal ownership of assets.

解释:

A is correct.

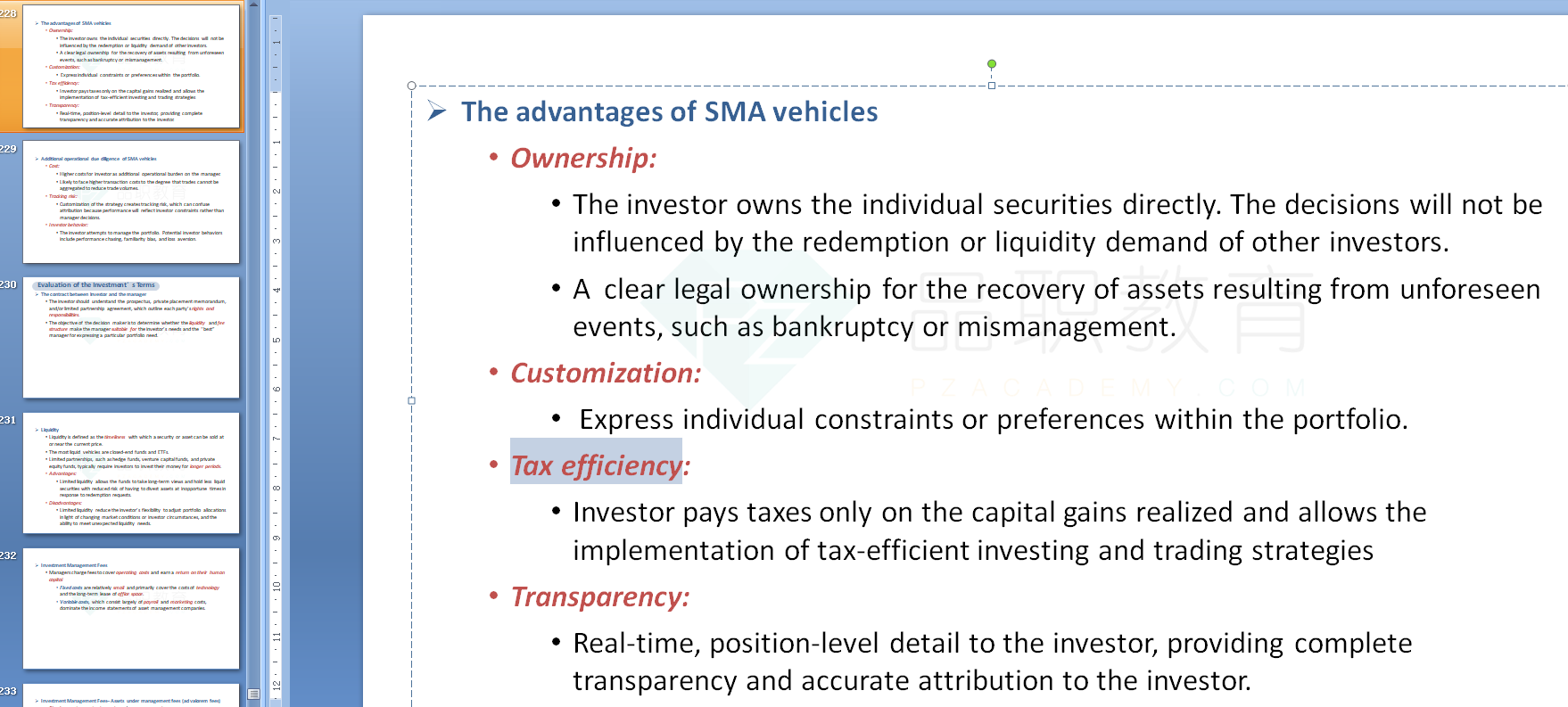

Pooled investment vehicles are typically operated at a lower cost than separately managed accounts because operational costs can be spread among multiple investors. An investor who is focused on tax efficiency would prefer a separately managed account because a separate account allows the implementation of tax-efficient investing and trading strategies, and the investor pays taxes only on capital gains realized. If the investor requires clear legal ownership, they would prefer a separately managed account in which the investor owns the individual security directly.

为什么B不对呢