问题如下:

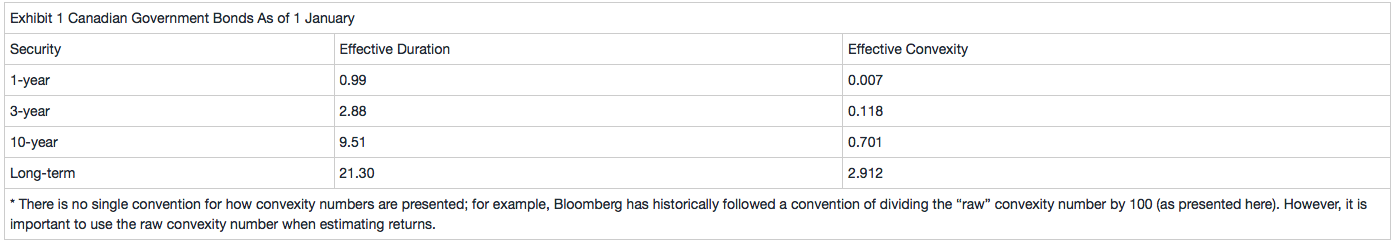

She notes that the duration of the 10-year bonds, along with the durations of the other portfolio bonds, aligns the portfolio’s effective duration with that of the benchmark. Selected data on Canadian government bonds are presented in Exhibit 1.

Sanober Hirji is a junior analyst with Northco Securities, which is based in Canada. The institutional clients of Northco are active investors in Canadian coupon-bearing government bonds. Client portfolios are benchmarked to a Canadian government bond index, which is a diverse maturity index portfolio.

Hirji then considers the scenario where the yield curve will lose curvature for the Malaysian institutional client. She notes that a 7-year Canadian government bond is also available in the market. Hirji proposes a duration-neutral portfolio comprised of 47% in 5-year bonds and 53% in 7-year bonds.

Relative to the Canadian government bond index, the portfolio that Hirji proposes for the Malaysian client will most likely:

选项:

A.underperform.

remain stable.

outperform.

解释:

C is correct.

Hirji proposes an extreme bullet portfolio focusing on the middle of the yield curve. If the forecast is correct and the yield curve loses curvature, the rates at either end of the curve will rise or the intermediate yields will drop. As a result, bonds at the ends of the yield curve will lose value or the intermediate bonds will increase in value. In either case, the bullet portfolio will outperform relative to a more diverse maturity index portfolio like the benchmark.

这个题目不是delta neutral 吗?5年和7年的债券怎么会同时买,不是一个买一个卖吗?同时买的话5年和7年都是增加duration的呀,怎么会出现delta neutral的情况?